There are few other blue-chip stocks that's vexing investors more than Telstra Corporation Ltd (ASX: TLS) as the stock looks set to be the worst performing large cap stock on our market.

The share price of our largest telco has crashed over 12% in the last month alone and is down a whopping 37% over the past 12 months, which is 42% below the annual gains of the S&P/ASX 200 (Index:^AXJO) (ASX:XJO).

But there's a way that Telstra can reverse its fortunes and trigger a re-rating in the stock that could come as early as next month, according to Morgan Stanley.

It won't be an easy task fighting the negative sentiment though as the market continues to be worried about the deterioration of its profitability which is likely to force management to cut its precious dividend.

Telstra's mobile business is under pressure as the entry of TPG Telecom Ltd (ASX: TPM) has triggered dramatic price drops and mobile data allowance increases, while the NBN is adding further margin pressure on Telstra's broadband division.

A dividend cut would trigger a revolt from within Telstra's ranks of retail investors who have bought and held the stock on the belief that its distributions are the next surest thing to a government bond.

While the way to Telstra's salvation may still involve a big and painful cut, it may not be its dividend that needs to be trimmed if Morgan Stanley is on the money.

The broker is suggesting that Telstra follows its Kiwi counterpart Spark New Zealand Ltd (ASX: SPK) in using a bigger knife to carve out costs.

Spark lit a fire under its share price when it unveiled a bigger than expected cost-out program and the stock is only 5% in the red over the past year and could outperform in the second half of calendar 2018. Spark is the best performing telco stock on the ASX given how steeply Telstra, TPG and Vocus Group Ltd (ASX: VOC) have fallen.

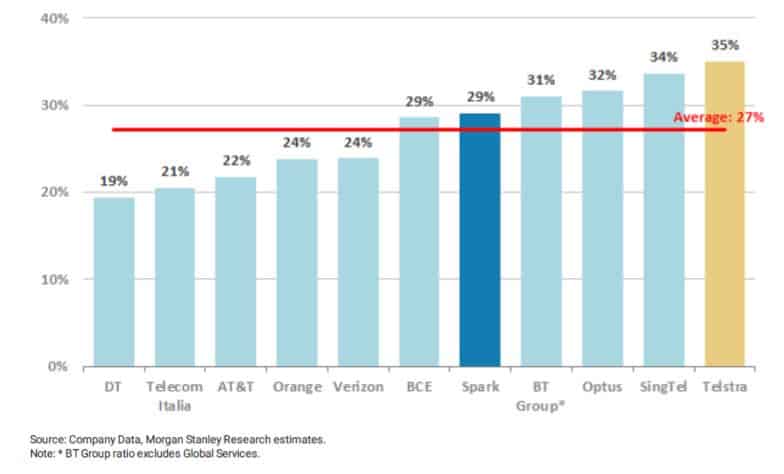

Funnily enough, it's Telstra's high cost base that is both a blessing and curse. Morgan Stanley estimates that our not-too-frugal telco has one of the highest operating expenses (opex)-to-sales ratios among its global peers at 35%. The average is 27%.

Hey There Big Spender: Opex excluding COGS as a percent of sales (FY17)

If (and even the broker acknowledges that it's a big "if") Telstra can lower its ratio to 32%, that could free up as much as $500 million to $1.5 billion over what Morgan Stanley is forecasting, which implies a 5% to 25% increase in the company's earnings per share (EPS).

"We note TLS has an investor day on June 20, 2018. We expect much discussion of new telco products and potential new sources of revenue (e.g., 5G)," said the broker.

"But we think the market's positive response to SPK's recent actions highlights that investors are likely most focused on what TLS says about its cost-out plans."

Cutting that much costs out of the system is no easy feat and is likely to involve restructuring and other related costs, but such a dramatic pruning of its opex will give investors greater confidence that the telco can sustain its 22 cents a share dividend.

I am pessimistic on Telstra and have written recently that I would only consider buying the stock once management announces a dividend cut as that will trigger a re-rating in the stock, in my opinion.

The notion that Telstra can cut that much costs out of its operations is intriguing and could achieve the same outcome.

We will only know how realistic that option is when on Telstra's Investor Day in three weeks. Stay tuned!