Don't be put off by the big crash in the share price of Metcash Limited (ASX: MTS) after its profit warning this morning. The sector is still primed for growth and the growth could be better than what the market is expecting, according to UBS.

That might be cold comfort for Metcash shareholders with the stock collapsing 17% to $3.06 in after lunch trade when the S&P/ASX 200 (Index:^AXJO) (ASX:XJO) index is 0.5% lower.

But the profit warning and news that Metcash has lost a big contract in South Australia won't change the outlook for Woolworths Group Ltd (ASX: WOW) and Wesfarmers Ltd (ASX: WES) even as both stocks have fallen in sympathy.

Metcash's issues are isolated to Metcash and the latest supplier survey undertaken by UBS points to bright days ahead for the sector.

The broker questioned 29 suppliers to the supermarkets on market performance, key trends and outlook. These suppliers cover around $21 billion of annual wholesale revenue, or about 30% of the local grocery market.

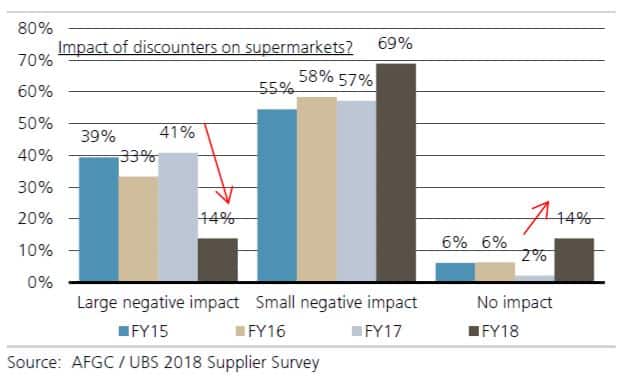

The respondents said they expected margins to lift and were tipping sales growth of 2.3% in FY19. What's more interesting is that only 14% of suppliers see supermarket discount chains like Aldi having a negative impact on the incumbents compared to 41% of respondents surveyed in 2017.

The Trend is Your Friend: Suppliers see less impact of discounters on market

But the supermarket operator that is tipped to benefit the most from the positive trend is Woolies as 72% of those surveyed said that it had the best strategy to win market share in the upcoming financial year

"The results suggest market growth will accelerate & that UBSe market growth could prove conservative (+3.5% pa), suggesting scope for sector outperformance," said the broker.

"We remain positive on the Australian grocery market and note a rising tide lifts all boats if growth improves. WOW remains our key pick with supplier feedback suggesting stronger top-line momentum could last for longer than expected."

Interestingly, the survey respondents have been negative on Metcash and neutral on Wesfarmers' owned Coles chain. Perhaps these suppliers saw Metcash's downgrade coming.

Woolies is the only stock in the sector that UBS has a "buy" recommendation on. The broker has a "neutral" rating on Metcash and Wesfarmers, although Metcash's update today isn't reflected in UBS' note.

But Woolies isn't the only blue-chip stock that's well placed to outperform. The experts at the Motley Fool have picked their three best blue-chips for 2018 that will likely outpace the broader market.

Follow the free link below to find out what these stocks are and why they should be on your radar this year.