Today's ASX quarterly rebalance has led to many changes in the primary indices, the S&P/ASX100 (INDEXASX:XTO), S&P/ASX200 (INDEXASX: XJO), and the S&P/ASX300 (ASX:XKO). Each index is a list of the largest companies in Australia by market capitalisation.

For example, the ASX100 is the 100 largest companies, the ASX200 is the 200 largest companies (and includes the ASX100) and so on.

Changes to the index, which occur quarterly, are important because many funds have a mandate to invest only in companies within the ASX200, for example.

As a result, a company being added to or dropped from that index can lead to a large increase in buying or selling over time. Companies that might be affected included Fairfax Media Limited (ASX: FXJ) and Vocus Group Ltd (ASX: VOC), both of which were dropped from the ASX100.

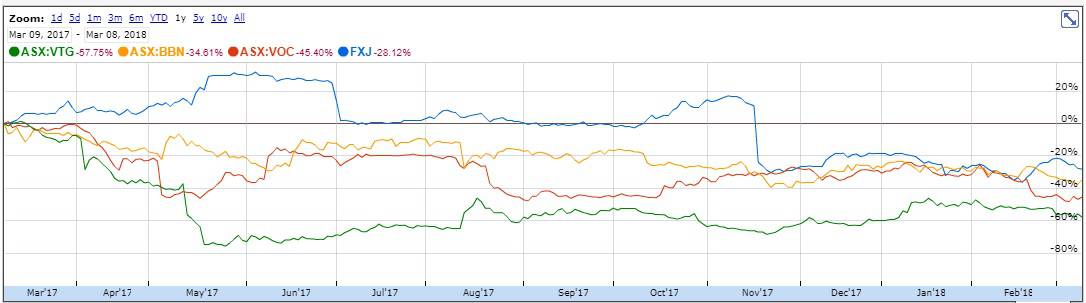

Baby Bunting Group Limited (ASX:BBN) and Vita Group Limited (ASX: VTG) were dropped from the ASX200 following poor share price performance over the past few months. Usually when a company gets dropped, it's because its share price has plunged, making it smaller than its next largest rivals. We can see that clearly here:

However sometimes, fast growing companies increase in value so rapidly that they push their competitors out. This has been the case with XERO FPO (ASX: XRO) and Lovisa Holdings Ltd (ASX: LOV), who absolutely rocketed in the last year, and were added to the ASX200 and ASX300 respectively this morning:

The quarterly index updates usually don't mean much, however they can prove a fertile hunting ground for investors looking for companies that are really successful (being added to the index) or possible turnarounds (being dropped from the index).