Retail Food Group Limited (ASX: RFG) ("RFG") released its half year results this morning, following a suspension from the ASX for failing to lodge its half year results by the end of February. The company will return to trade on Monday.

The results themselves however, weren't good, with profits tumbling despite a 21% increase in revenue to $196 million. Underlying profit, which excludes 'significant events', fell 32% to $25 million. Underlying earnings per share fell similarly, and the company cancelled its dividend in order to conserve cash.

The statutory results revealed a loss of $88 million after tax, due to $138 million in pre-tax write-downs.

The write-downs were due to:

- Brand System impairment of $84 million

- Store closure costs of $35.7 million (due to closure of 160-200 domestic stores)

- $18.3 million in property & equipment/inventory write-offs

In a nutshell, Retail Food Group had to reduce the value of several of its franchises (Michel's, Pizza Capers, and the Coffee Retail division) due to underperformance. Michel's Patisserie, a long struggling franchise, was the worst performer by far.

I would guess that at least part of the delay in releasing the report may have been due to internal discussions about the assumptions used to value these businesses.

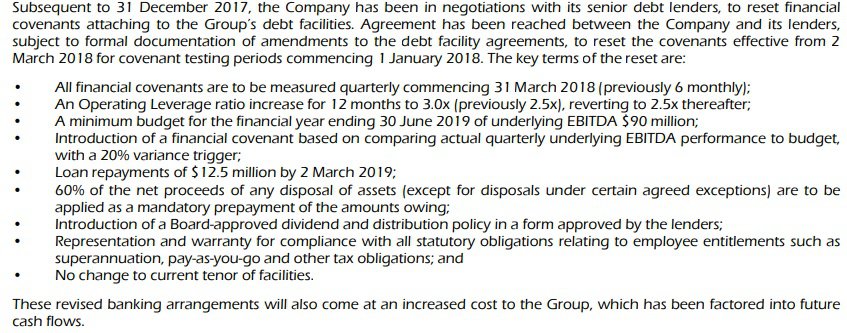

The other reason for the delay in filing accounts was likely due to negotiations with lenders regarding Retail Food's debt. Management reported that it has extended its 2018 debt by another 2 years until 2020, and it has been required to make changes to its banking covenants as a result:

You can see that the list of covenants here is quite strict. Any variance from 'quarterly underlying EBITDA' (earnings before interest, tax, depreciation and amortisation) of more than 20% will result in a 'trigger' which I presume means that the covenant will have been breached (this will lead to adverse consequences with lenders). Sixty percent of proceeds from any asset sales have to be applied to debt, the company must guarantee all employee obligations (superannuation payments, etc), and so on.

Management announced it would reinvest to deliver cost savings for Retail Food, and cost savings and revenue growth for its franchisees also.

Ultimately I think that remaining in compliance with these covenants will be quite difficult for Retail Food (which is kind of the point), and with all the extra costs and store closures I think it is going to get a lot more difficult.

I think that there is an even-money chance that the company's financial situation deteriorates further, and I don't expect a reinstatement of the dividend in a hurry.

To me the big question is "how much does Retail Food Group depend on attracting new franchisees?" It's not an easy question to answer, but the company has to close up to 200 stores, presumably because it can't attract franchisees.

After all the negative media coverage and negative reports on the RFG franchise model, it seems possible that attracting new franchisees will be very difficult, and current franchisees may elect not to renew when the time comes.

I don't think there will be a quick recovery for Retail Food's business, and I think there is a reasonable chance that the company's earnings and financial situation will continue to deteriorate. While I am open to the possibility of bargain hunting if shares fall far enough, I'm currently inclined to avoid the company.