Research undertaken by Griffith University and No More Practice Education recently has discovered that more than 80% of Gen X and Y Australians may not be able to afford a comfortable retirement.

This is because, by 2043, between $2.06 million and $3.98 million will be needed, assuming a conservative annual inflation rate of 2.5%.

If Australia's long-term inflation rate of 5.07% figure is used in the projections, then it could mean up to 94% of people born between 1966 and 1994 will fail to achieve a decent retirement nest-egg.

Over the next 20 years, 75% of Gen X and Y with surviving parents are expected to inherit at least $110,000 — as a part of an overall wealth transfer between generations of $3.5 trillion. There is, however, a fear that this money could be squandered on lifestyle rather than being invested over the next three decades.

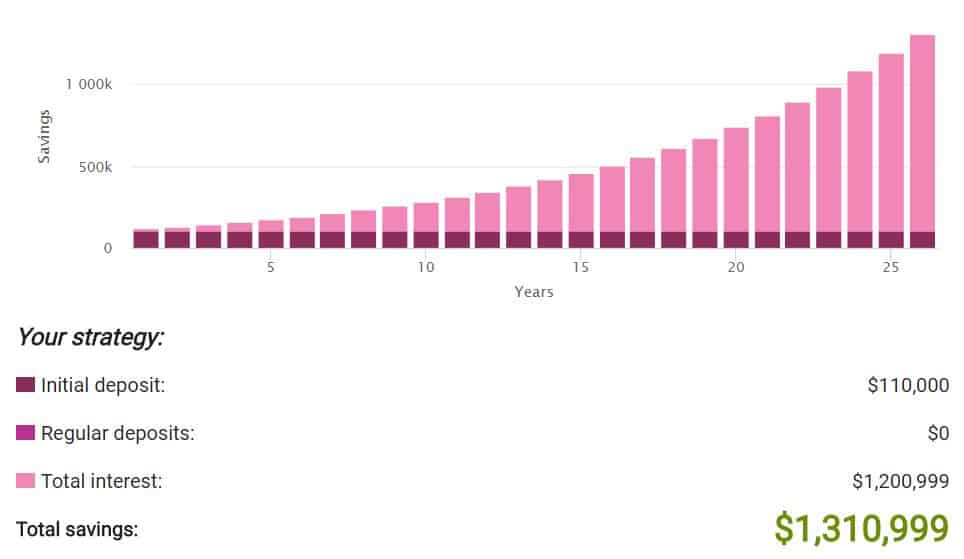

Now, imagine what $110,000 could do for you over a 26 year investment time frame, assuming a 10% per annum return — the same average annual return achieved by the Australian stock market since 1970.

Here's one answer:

Source: www.moneysmart.gov.au

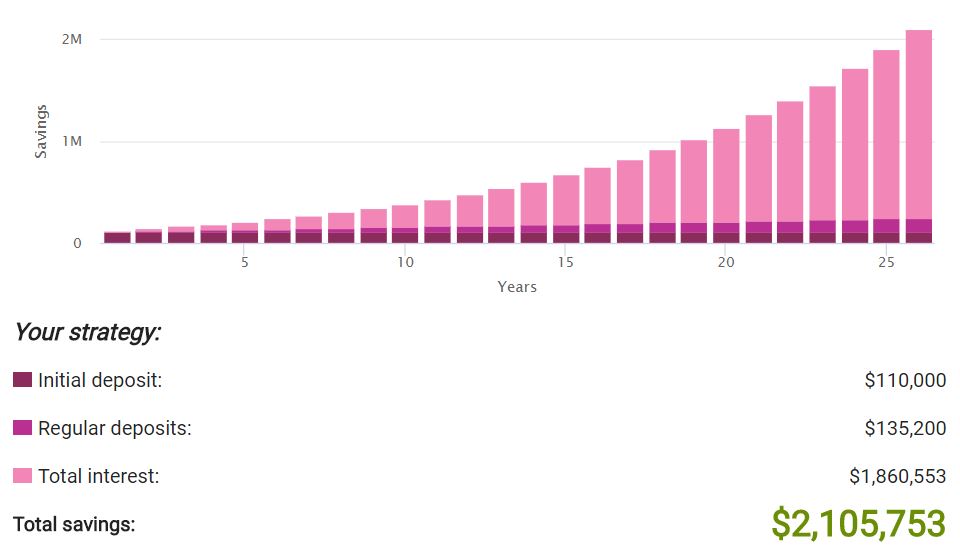

If a 34-year-old was to add $100 per week for the next 26 years — in addition to a hypothetical $110k — you'd have this:

Source: www.moneysmart.gov.au

You can see for yourself the effect that regular savings can have on on financial outcomes. Compound returns mean that $100 per week over 26 years ($135,200) can mean a difference of almost $800,000 at retirement.

5 stocks to help you get there

Regardless of your financial situation, and no matter how much you have today, the five companies below will help you to achieve your financial goals over the very long term, especially if you combine these with the habit of regular savings and investment:

- CSL Limited (ASX: CSL) is a developer and manufacturer of biopharmaceutical products and blood plasma therapies globally. With $2.6 billion invested in research and development over the last 5 years, there should be plenty of scope to improve and expand on its pipeline of products over the next few decades. This is a proven wealth generator.

- SEEK Limited (ASX: SEK) is a provider of market leading online employment marketplaces here in Australia and in strong growth markets around the world. Its CEO — Andrew Bassat — owns over $260m in shares of the company, and if there there was ever an ideal a place to park your long-term money, this is it.

- Pro Medicus Limited (ASX: PME), a leading health imaging IT provider to hospitals, imaging centres and health care groups worldwide, has growing returns on equity and strong revenue growth. On a global basis, it's still a small company and has a long runway in front of it.

- Praemium Ltd (ASX: PPS) has had board troubles recently which has meant the focus, for a short time at least, has moved away from the main game of providing portfolio administration and investment platforms to clients around the world. However, these ructions are behind us now, and with record inflows and funds under administration passing $6.6 billion recently, its future looks positive.

- InvoCare Limited (ASX: IVC) is well placed to benefit from the inevitable passing of the baby-boomer generation. It's a funeral services company operating and owning 270 funeral home locations and 16 cemeteries and crematoria under various brands. If you can deal with the nature of the business — it does force us to think about own own mortality after all — you should see that InvoCare is going to do quite handsomely over the next 20 years in my view.

Foolish takeaway

I know it's probably one of the hardest things in the world to do: encouraging a 20 or 30-year-old something person to think about retirement.

But the arithmetic is pretty compelling. A regular savings schedule, combined with a solid investment plan and heaps of time, can mean a world of difference to the average wage-earner.

The stock ideas above too are a nice blend of dividend-paying and growth, but 5 stocks won't be enough to be considered a diversified portfolio. If you click on the link below, you'll discover other stock ideas which, when combined with a regular savings plan, should help you to avoid a poor retirement.