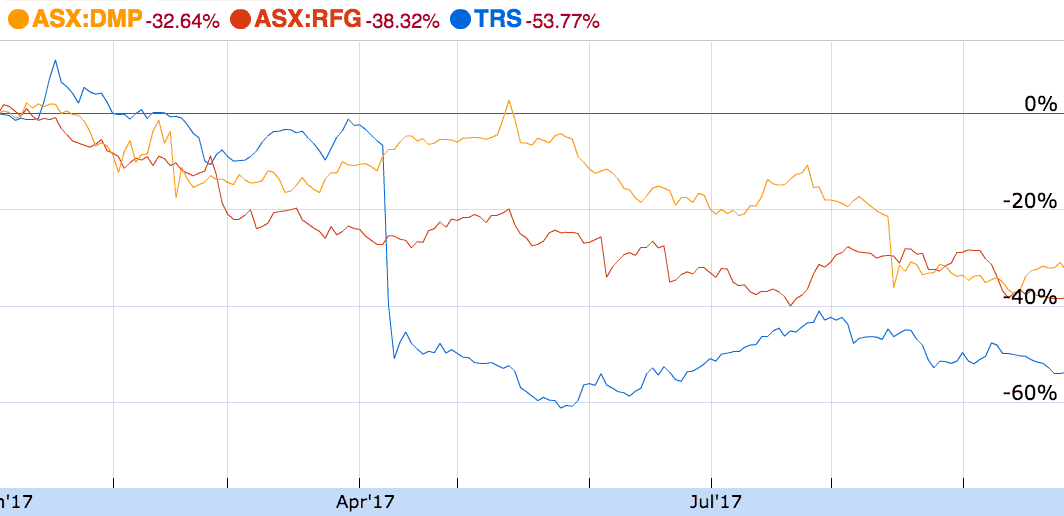

ASX shares of Domino's Pizza Enterprises Ltd. (ASX: DMP), Retail Food Group Limited (ASX: RFG) and Reject Shop Ltd (ASX: TRS) have been slapped down in 2017.

Down on their luck

Reject Shop

Fellow Motley Fool writer Tristan Harrison covered the situation in which retailer The Reject Shop finds itself. Basically, the company is being beaten at its own game of selling low-cost everyday items at the best possible prices. Kmart, owned by Wesfarmers Ltd (ASX: WES), continues to dominate its rivals.

However, at these prices, shares of The Reject Shop might be getting tempting for some investors who are eyeing its enormous trailing dividend yield. If it can get its product mix just right, the current share price may prove to be a great opportunity. But it's not one for me — or the faint hearted!

Domino's

A stretched valuation and allegations of staff underpayment rarely bode well for public companies like Domino's. The proliferation of third-party digital ordering systems like UberEATS and Deliveroo might also be spooking investors, as Domino's has long held a technology advantage over its rivals.

Nonetheless, the company continues to post growth locally and abroad. And at today's prices, Domino's shares are better valued than they were a year ago. However, I'm not a buyer even at these levels. Therefore, it remains on my watchlist.

Retail Food Group

In addition to Domino's, ASX investors were fearful that a fallout from industry underpayment might affect Retail Food Group, with its many operations in casual dining. Then, there were fears that its growth might be slowing and changes to accounting standards might affect the business model.

However, at current prices, Retail Food Group shares are trading at a large trailing yield and on a modest multiple of profit.

Foolish Takeaway

Given the selloff which each of these companies has endured in 2017, I have them on my watchlist pending further research and analysis. Indeed, given their track records, I'm not in a rush to write them off!