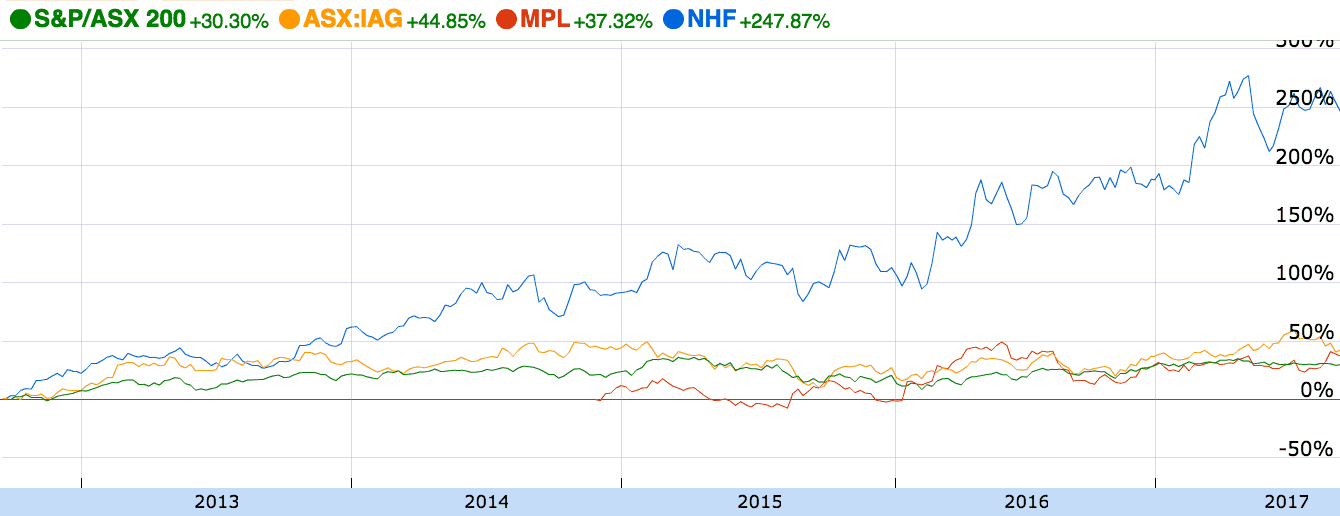

Are shares of Medibank Private Ltd (ASX: MPL), Insurance Australia Group Limited (ASX: IAG) and NIB Holdings Limited (ASX: NHF) on your watchlist? Well…they should be.

Aussie Health Insurers Outperform

Medibank

Medibank is Australia's largest private health insurance business, operating the Medibank and ahm brands. Last month, Medibank reported 7.6% profit growth and declared full-year dividends of 12 cents per share, placing its shares on a 4% dividend yield.

Looking ahead the company and analysts are expecting subdued growth. According to The Wall Street Journal's analyst ratings, Medibank shares are fairly valued.

Insurance Australia Group

IAG, which is part-owned by the famous US investor Warren Buffett, is a general insurer which owns brands NRMA, CGU, SGIO, Coles Insurance and more. IAG recently reported a solid batch of results to the market, with full-year dividends of 33 cents per share. Currently, it is forecast to yield dividend income of 5.2%.

In the analyst community, the company is forecast to grow profits modestly but lower its dividends in the near future. However, the company's shares trade at a premium valuation to the market's average.

NIB Holdings

NIB has grown quickly to become a $2.5 billion health insurance company, with extensive operations in Australia and New Zealand. Last month the company announced 30% profit growth and full year dividends of 19 cents per share, up 29%. That places its shares on a dividend yield of 3.3%.

In coming years NIB is expected to achieve more modest growth, with dividends following suit.

Foolish Takeaway

Insurance companies can be fantastic businesses if they price premiums correctly and invest their 'float' — the money collected from premiums — effectively. However, few Australian insurers do both with great success.

NIB is my pick of these three companies because I expect it to achieve superior profit growth to Medibank and IAG over the next five years.