Are shares in Australia's biggest telecommunication businesses up for sale at bargain prices?

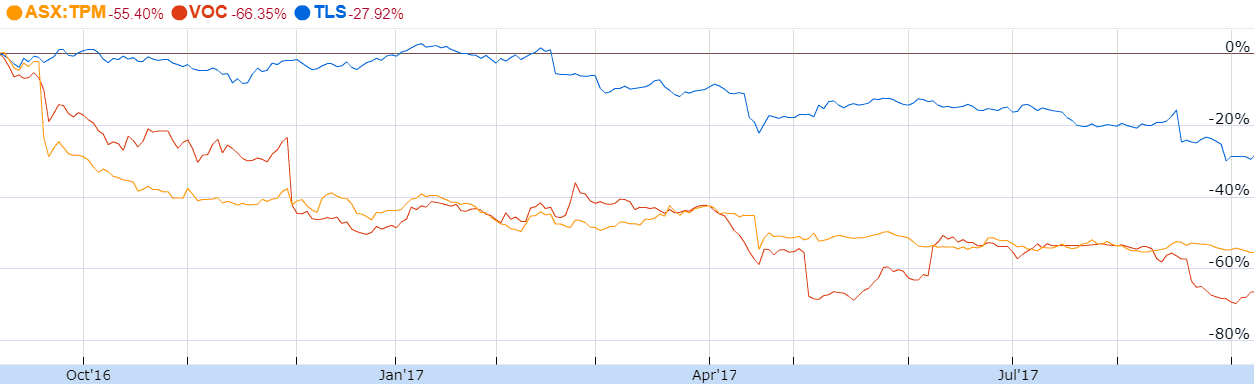

Telstra Corporation Ltd (ASX: TLS), TPG Telecom Ltd (ASX: TPM) and Vocus Group Ltd (ASX: VOC) have been heavily sold down over the past year, as this graph shows:

Australia's largest telecommunications business, Telstra, has been heavily sold down in recent times. Whether it is the prospect of losing its cable network to the Government's NBN, potentially rising interest rates or TPG's decision to launch a mobile network, Telstra is facing some hard choices.

Another tough piece of news was Telstra's admission that it would lose up to $3 billion in operating profit and cut its dividend in coming years. However, with almost one-third of its share price disappearing over the past year, I think it is time for investors to start running the ruler over Telstra.

TPG Telecom is Australia's third-largest telco behind Telstra and Optus. It is a well-run business and founder-led. With two strategic investors, including its Chairman and Washington H. Soul Pattinson & Co. Ltd (ASX: SOL), I think retail shareholders can rest a little easier knowing that genuine long-term investors are backing TPG's success.

TPG plans to launch a mobile network throughout Australia and Singapore, build out its fibre optic network and snatch market share from competitors on the NBN. To some investors that may appear to be a risky strategy, but in my opinion TPG shares have a price to match the slightly more uncertain outlook.

Finally, Vocus Group is the owner of Dodo, Primus, Eftel and more. It also owns consumer, business, and corporate telecommunication brands locally and in New Zealand. The company has been rocked by management issues and integration headaches, following an acquisition spree.

Following two attempted takeovers, investors are perhaps a little nervous about the business and what comes next. However, although it is a higher risk investment idea, it still has some good assets under its banner.

Foolish Takeaway

The Australian telecommunication industry has come back to more realistic valuations. Last year, the industry was expensive with investors expecting more and more profit growth. However, I think this sector of the market could prove to be rich hunting grounds in the not-too-distant future.