The Wesfarmers Ltd (ASX:WES) share price rose 1% $42.11 this morning after the company released its annual results. It was a cracking year for the company, with revenues up 3.7% to $68,444 million. Underlying profit after tax rose 28% to $2,873 million after excluding the impact of the Target and Curragh write-downs last year. The company earned 254 cents per share and paid 223 cents per share to shareholders.

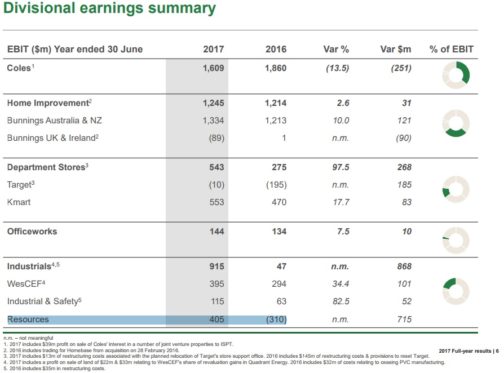

In terms of the individual businesses, coal was a definite standout:

The $700 million swing from loss to profit in the value of the resources division pretty much accounts for the majority of Wesfarmers' earnings growth this year. Officeworks and Bunnings both display significant improvements in earnings, although Coles earnings fell heavily due to significant competition, lower prices, and increased investment in the business.

Wesfarmers also lowered its debt significantly during the year by repaying medium term notes and selling the receivables to its Coles credit cards.

The outlook for Wesfarmers is mixed, with some businesses like Bunnings UK, Kmart, and Target adjusting to challenges and requiring significant ongoing investment. Bunnings UK is loss-making, and competition in the Australian grocery sector doesn't seem to be getting any easier for Coles. Woolworths Limited (ASX: WOW) and Metcash Limited (ASX: MTS) are both investing heavily in their grocery business, and so are disrupters like Aldi.

Managing director Richard Goyder said that the group was generally optimistic, although the company is conducting a strategic review of its Resources business which may lead to a divestment. Shareholders will know that the Officeworks IPO was recently put back on the shelf, although this may come up again in the future too. Wesfarmers remains a high quality company but it faces some challenges in the near future.