- What is an NFT?

- What does ‘non-fungible’ mean?

- How do NFTs make use of the blockchain?

- What are NFTs used for?

- How do I create an NFT?

- Why are NFTs important?

- The ‘why’ for artists

- The ‘why’ for buyers

- The ‘why’ for everyone else

- ASX companies involved with NFTs

- How to invest in NFTs

- What should investors look for when buying NFTs?

CryptoKitties, Bored Apes, and Lazy Lions… the world of non-fungible tokens – or NFTs – can be an outright zoo for newcomers to navigate. (Not to mention the flood of questionable NFT projects launched by influencers and anonymous individuals as this relatively new digital item quickly gained popularity).

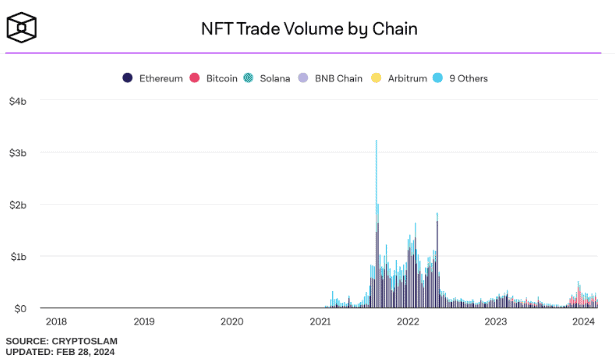

Reaching peak euphoria in August 2021 when it notched up A$4.9 billion in monthly NFT trading volume, the non-fungible token market is a skeleton of its former favour among speculators.

Years have passed since its moment in the spotlight, yet the concept of NFTs remains obscure to many. What they are, how they work, and where and how to buy them allude many. That's where we come in.

Image source: Getty Images

What is an NFT?

In its simplest form, a non-fungible token – or NFT – is a digital item that is uniquely identifiable due to its creation and existence on a blockchain.

That statement probably has a few concepts to unpack, so let's break it down further.

What does 'non-fungible' mean?

If an object is non-fungible, it simply means it is not replaceable, or in other words, 'unique'.

Reframing the statement, if an object or item were considered fungible – the opposite of non-fungible – it is exchangeable for another of its kind. An example of a fungible item would be a $20 note. It is not unique, and we can swap two $20 bills without concern about one being valued differently from the other.

In contrast, an NFT is more akin to a collectible – specifically, a digital collectible. Think of your stamp, comic book, or Pokémon card collection, but in digital form. These objects are examples of non-fungible items because they each have unique characteristics (such as rarity, condition, etc.) that result in variance in perceived value.

An NFT's 'token' portion merely implies some form of representation. In this case, a digital identifier or code tracked on a blockchain. This is what helps people distinguish one NFT from another.

Now, you might be thinking: aren't these token things just like cryptocurrency? While non-fungible tokens share some similarities with crypto, there are also some key differences.

How do NFTs make use of the blockchain?

One commonality between crypto and NFTs is the use of blockchain technology to keep track of transactions and ownership.

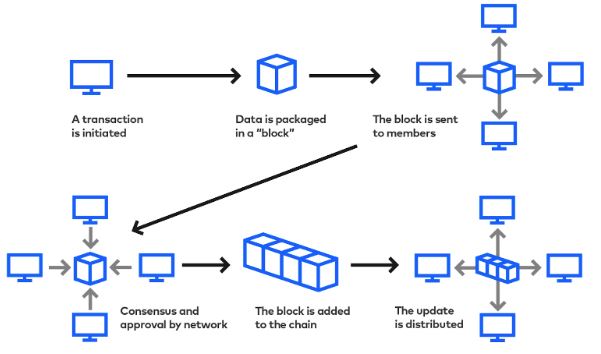

Really quickly, a blockchain is essentially a digital record of information. Think of it like a spreadsheet that constantly updates, showing who owns what. But instead of people entering the data, it's all handled by a sophisticated string of computer code.

Non-fungible tokens use inherent blockchain qualities, such as those offered by the Ethereum blockchain

Non-fungible tokens use inherent blockchain qualities, such as those offered by the Ethereum blockchain (although many others now host NFTs as well). These essential characteristics include immutability, verifiability, security, and typically fast settlement.

Ownership of an NFT is easily and readily provable thanks to the application of blockchain technology. At its core, NFTs borrow the same cryptography concepts that cryptocurrencies use to make digital ownership and exchange possible – a public and a private key.

The best way I can explain this is by using an analogy…

Imagine a mail chute made of Perspex. At one end is a depositing chute locked with a public key that only allows people to drop off items. A door locked with a private key at the opposite end provides access to the items.

If you were to buy an NFT, you would share the public key with the other party so they can unlock the depositing chute. However, the private key is, well… private, and you would use that to access your received NFTs. Meanwhile, because the mail chute is transparent, everyone can see all your digital collectibles, but cryptography keeps them safe at all times.

So, now we know that cryptocurrencies and NFTs both use blockchains to track who owns them, what exactly can people do with NFTs?

What are NFTs used for?

Now that we have an understanding of what an NFT is and how it works, the next question is: What would anyone use these strange digital collectibles for? In short, just about anything you can think of can be made into an NFT. Some examples include:

- Tickets/passes

- Digital artwork

- Music

- Gaming content, such as characters and in-game items

- Virtual worlds

- Domain names

- Posts on X (formerly Twitter) – yep, we're not joking.

The applications for NFTs are endless, as they can be used to represent anything that can be digitalised. This means that we're only limited by our imagination when it comes to what NFTs can do.

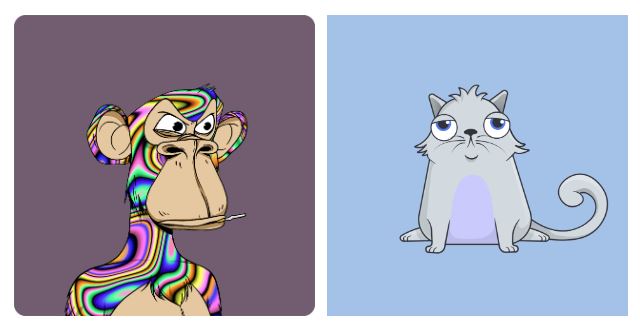

One of the earliest and most famous examples of NFTs in use is the cryptocurrency game CryptoKitties. Players can purchase, collect, breed, and sell digital cats in this online game. These kitties are each represented by an NFT on the Ethereum blockchain.

While CryptoKitties might seem like a bit of harmless fun, the game actually did quite a lot to further NFT adoption. In fact, by late 2017, CryptoKitties was responsible for more than 10% of all Ethereum network traffic,

From there, the number of NFT use cases has exploded. NFTs have been used to represent everything from in-game assets to even real estate.1

How do I create an NFT?

If you want to become an NFT creator, you will need a digital wallet with some cryptocurrency in it. The cryptocurrency required will depend on the blockchain the NFT is created on and the NFT platform being used.

Currently, the most popular blockchain for NFTs is the Ethereum (CRYPTO: ETH) network, so the crypto token used for fees during the creation process would be Ether. Other networks, such as Bitcoin and Solana, have recently seen NFT trade volumes increase as new collections explore alternative chains.

The next step in the NFT creation journey is to jump on the internet and head to an NFT platform, such as OpenSea, LooksRare, or Nifty Gateway. This is where people can upload digital files, whether an image, GIF, video, etc. For a small fee, the marketplace will do all the complicated tasks, such as generating the 'smart contract'.

Once created – or 'minted' – the unique crypto asset can be bought and sold while its ownership is indisputably traced on the blockchain. This is made possible by the uniquely identifiable smart contract that is inextricably linked to the artwork.

You're now an NFT creator! Who knows, you might have just taken your first steps toward creating a multimillion-dollar piece of work, such as those by digital artist Beeple (pictured below) or Damien Hirst.

Why are NFTs important?

Ultimately, the importance of non-fungible tokens comes down to each person's intended application.

The 'why' for artists

Any aspiring creative will be acutely aware of how hard the art industry is to crack. And this challenge is only amplified when working with a digital medium rather than traditional physical items.

Unfortunately, digital art is much easier to replicate and redistribute than its physical counterpart. This issue has long plagued artists hoping to sell their work online.

Many will be quick to point out that NFTs still don't stop someone from 'right-clicking' and saving. However, it does introduce provable scarcity to the official NFT art.

Furthermore, traceability allows artists to collect royalties on each NFT transaction, including re-sales. By enabling this recurring revenue stream, creatives can derive a more sustainable income from their work.

The 'why' for buyers

NFTs make it possible to easily collect and store digital items in a way that is secure, decentralised, and easy to access.

Prior to non-fungible tokens, items of value had to be entrusted to an independent party for authenticity verification. This process comes with associated costs, making the transaction more expensive for the seller and the buyer.

The traditional art world has long lacked a high level of liquidity. It's a product of wealthy gatekeepers and middlemen (auction houses) who take a hefty fee to ensure authenticity and provide a means of exchange.

However, a buyer can now make an informed decision on an item's authenticity themselves due to the evidence provided on the blockchain.

The 'why' for everyone else

There are countless other industries and applications where the existence of NFTs could prove significant with time.

One prevalent example is the inclusion of NFTs in gaming. Ark Invest's research shows that the video game content and services industry could grow from $200 billion in 2021 to more than $400 billion by 2026. A large chunk of video game spending is derived from in-game items such as character clothing and accessories, which would lend themselves well to the NFT format.

Additionally, NFTs could immortalise items of significance and remove the risk of loss through fire, war, theft, etc.

Finally, another left-of-field application could entail using NFTs in supply chains. For instance, a physical item could be linked to an NFT, which carries the record of the product's journey over its life. This could be valuable for sustainability data, food contamination tracing, delivery tracking… and so on.

ASX companies involved with NFTs

The burgeoning NFT market has spilled over into Australian equities as publicly-listed companies dip their toes into this developing world.

At this stage, a handful of ASX-listed companies have been involved in the digital asset world to some extent.

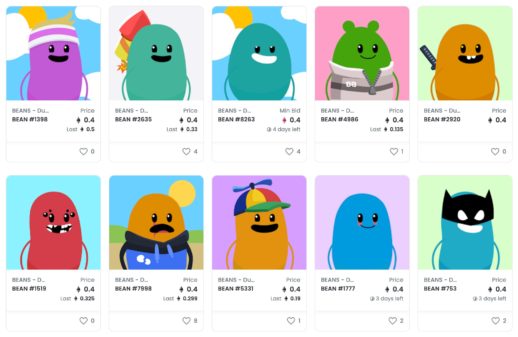

Firstly, Playside Studios Ltd (ASX: PLY) is one of the ASX companies most directly associated with NFTs. The Aussie game developer launched its own NFT project comprising 10,000 unique digital collectibles (BEANS) from the 'Dumb Ways to Die' franchise that will be involved in an upcoming metaverse game.

Another example of an ASX company testing the waters of the NFT industry is Treasury Wine Estates Ltd (ASX: TWE), which sells limited-edition wine through redeemable NFTs.

However, it is a delisted company that might have made the most significant imprint on the Australian share market.

Hong Kong-based Animoca Brands, formerly trading under the ticker AB1, has grown into a $7.8 billion NFT powerhouse despite being ousted by the Australian exchange operator in March 2020 for failing to meet its continuous disclosure requirements.

The company's valuation has exploded due to the success of numerous NFT businesses it has invested in, such as Dabber Labs, Axie Infinity, OpenSea, and The Sandbox.

How to invest in NFTs

Now that you have a grasp of what NFTs are, it might be prudent to learn what is involved in the process of investing in one.

Typically, there are four main steps to obtaining NFT ownership:

- Buy cryptocurrency to purchase an NFT

- Transfer crypto to a digital wallet intended to connect to an NFT marketplace

- Choose your preferred marketplace for transacting

- Research and buy an NFT.

Let's take a more granular look at how this investing process plays out.

To get started, we need to use cryptocurrency to buy the NFT. Importantly, the specific crypto required depends on the NFT marketplace we intend to use. With the Ethereum network handling 76% of all NFT sales so far, Ether will likely be the token required.

You can get a hold of the cryptocurrency you need via the plethora of available exchanges, including Coinspot, Swyftx, Binance, and Coinjar. Keep in mind that some of the tokens will be consumed by fees when transferring and transacting.

After purchasing the crypto to buy an NFT, you will want to transfer it to a digital wallet capable of connecting to the NFT marketplace that you'll be using. A common wallet used for interfacing with marketplaces is MetaMask. If you haven't already set up a MetaMask wallet, check out the website2.

Once you have connected your pre-loaded wallet to an NFT marketplace, such as OpenSea, you can begin bidding on and buying digital assets to your heart's content. Note that NFTs can vary significantly in price. From a few dollars for a CryptoKitty to potentially millions for a Bored Ape, and everything in between.

Accounting for fees, it is probably wise to start with at least $200 to make your first NFT investment. Never invest more than you can afford to lose, though.

A bit of research is essential to give yourself the best chance of making a profitable investment. What to look into will depend on the type of NFTs you're interested in buying.

For digital art, much of the research is on the artist, applying many principles of valuing traditional art. Meanwhile, a project offering utility or gaming heavily depends on the team behind the work.

Finally, you have found the NFT you've been looking for… Now what? It can be as simple as hitting 'buy now'. Your wallet will prompt you to authorise the transaction. After confirmation, the agreed crypto amount for the NFT will be deducted from your wallet (along with fees) in exchange for the digital token.

Hooray! You've now joined a community of NFT holders.

What should investors look for when buying NFTs?

Even diehard NFT enthusiasts are wary of the possibility that most NFTs have the potential to become worthless. This is primarily because of the sheer number of NFTs being created, many without the credentials to sustain long-term value creation.

So, what are the crucial characteristics to look for in an NFT?

- Reputable people behind the project/art

- A thriving community feeding back into the project

- Utility (play-to-earn NFT games)

- A rich history. For example, CryptoPunks are considered among the first to launch the now-popularised project concept of 10,000 unique characters

- 'Emotional stickiness', as crypto and NFT investor Ben Yu likes to call it.

According to Yu, "If you're going to feel sad selling it, even for a huge gain – chances are others are going to feel the same way, and thus fewer of that asset will ever go on sale on the market, and as we all know – the intersection of supply and demand is what determines price."

Lastly, ensuring they are genuine is the most crucial aspect to look for when investing in NFTs. While the uniqueness of a non-fungible token is indisputable, bad actors and profiteers can create lookalikes to deceive buyers. Take a look at the example below from the World of Women NFT collection:

One is from the renowned World of Women project, while the other is a mirrored copycat. One is worth a few dollars, while the other is sold for thousands. Don't be confused and think you're getting a bargain on an acclaimed project – unless you're intentionally collecting copycats.

To avoid being duped, look for the 'verified collection' blue check on the NFT collection page. If searching for individuals is more your vibe, popular artists usually wear a blue checkmark badge as well – see below.

These precautions should help weed out the potatoes from the Picassos.

The world of NFTs is vast, but if you have made it here, you hopefully now have a sturdy grasp of all things non-fungible.