We're 22 months into one of the best bull runs for the gold price ever, and it continues to push ASX gold shares to lofty new heights.

Last week, the four largest ASX 200 gold stocks hit new records as the gold price lifted to an all-time high of US$4,379.60 per ounce.

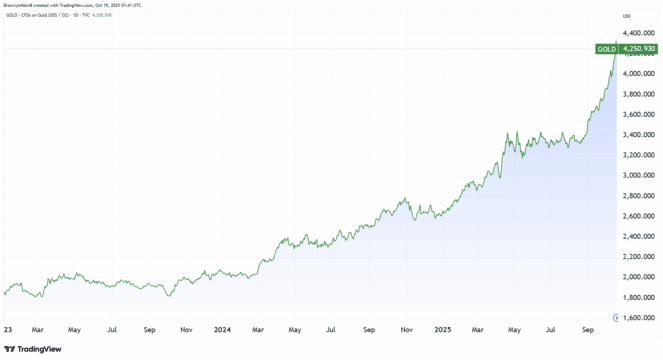

The chart below shows the gold price from 1 January 2023.

As you can see, the bull run began in early 2024, with the gold price rising 27% over the year — its best annual performance since 2010.

However, that pales in comparison to what's happened this year.

In 2025 to date, the yellow metal has risen a further 66%, prompting tremendous price growth for ASX gold shares.

Source: TradingView

Are you thinking of buying ASX gold shares?

The commodity's incredible run appears set to continue, according to the experts.

Goldman Sachs tips the gold price to go to US$4,900 per ounce by the end of 2026, while French bank Societe Generale SA is slightly more bullish at US$5,000 per ounce over the same time frame. Both brokers say their estimates have more upside than downside risk.

The gold price is being driven higher by ongoing central bank buying over several years, and more recently, huge inflows into gold ETFs.

Despite this, it is understandable that investors who have sat out the gold rush may be hesitant to get in now after a 22-month run.

The obvious risk is buying at the top of the cycle.

On Friday, the market's largest ASX gold share by market capitalisation, Northern Star Resources Ltd (ASX: NST), set a new record at $26.52, up 91% over the 22 months.

The second-biggest gold mining share, Evolution Mining Ltd (ASX: EVN), hit a historical peak of $12.04, up 195% since 1 January last year.

Newmont Corporation CDI (ASX: NEM) shares also reached a record $152.72, up 147% over the 22 months, and Genesis Minerals Ltd (ASX: GMD) peaked at $7.17, up 280% over 22 months.

As we've reported, small-cap gold miners have seen the most spectacular gains, with one gold stock rising 9,600% in 2025 alone.

After such big rises, it's only natural for fence-sitting investors to assume limited upside from here, or even an impending correction.

But get this.

Had you bought ASX gold shares just one month ago, you'd have a 25% return by now.

Say, WHAT?

In just the last month, this happened

Yes indeed, the S&P/ASX All Ords Gold Index (ASX: XGD) rose by a staggering 25.67% over the past month.

Adding insult to injury for hesitant investors, two ASX gold ETFs rose by 19% and 23% during September.

That put them among the top five performers out of hundreds of ASX ETFs trading on the Australian market last month.

Thus, it is still soooo tempting to buy in, but some analysts say the market is flashing red, and the risks from here may be high.

For starters, if the gold price continues rising for the reasons stated earlier, that doesn't guarantee that ASX gold shares will keep going up.

Far East Capital, a mining investment advisory firm, says profit-taking on ASX gold shares is likely at some point.

Profit-taking refers to a wave of investor selling to lock in gains after price rises, which can place downward pressure on share prices.

In an article published by Listcorp, Far East Capital commented:

Given such amazing increases in such a short time frame, logic will tell you that there will inevitably be some profit taking, soon.

However, if the gold price remains above US$4,000/ oz, you could even see more money being sucked into the market.

It is probably too late to be buying many stocks right now as they have run so hard. You need to see if the upward momentum is maintainable into the new week but many stocks could fall by 10-20% or more in that period of deliberation.

On SBS News, Isaac Poole, the global chief investment officer at Oriana Private Wealth, said retail investors were coming late to the party.

Poole commented:

When you look at what's really been pushing demand in gold at the moment, it's been ETFs.

You are seeing this huge financialisation of gold bullion through ETFs and retail investors racing out to buy after the market's already up 70%.

I think that's been the big story over this year and particularly the last month.

Are there any undervalued ASX gold shares left?

Far East Capital says there are some junior ASX gold shares that have not yet had their day in the sun.

There are a small number of bargain basement [mining] stocks that haven't yet run, and maybe money will roll into them — provided they have at least some merit.

There are a few gold stocks in this category as they are in the middle of commissioning activities.

There are also stocks undertaking capital raisings that invariably subdue prices for a short time.

Aussies selling their gold jewellery

Besides buying ASX gold shares, another way to 'gain exposure' to the record gold price is to sell your gold jewellery.

Nick Ireland, a leading jeweller with studios in Sydney, Melbourne, and Brisbane, said many customers are coming in to sell this year.

Ireland said:

Customers are pleasantly surprised at what their old jewellery that was sitting in a drawer, unworn, is worth today.

This week, we bought a 9-carat gold chain for $700. Two years ago, we would have paid $310.