BHP Group Ltd (ASX: BHP) shares are down 0.57% to $42.90 while the S&P/ASX 200 Index (ASX: XJO) is also down 0.39% today.

The Big Australian is known as a global iron ore giant, and it remains the world's lowest-cost major iron ore producer.

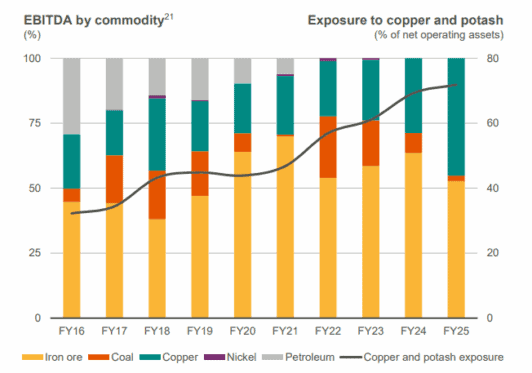

But BHP has been increasingly investing in copper in recent years, so much so that copper made up nearly half of its earnings in FY25.

BHP released its full-year FY25 report last Tuesday.

It showed that copper made up 45% of total underlying earnings before interest, taxes, depreciation, and amortisation (EBITDA) in FY25.

That's up from 29% just one year ago.

Copper EBITDA came in at a record US$12.3 billion in FY25, up 44% compared to FY24.

The growth of copper as a percentage of BHP's annual EBITDA is shown in the graph below.

Source: BHP Results Presentation FY25

'Big Red': BHP is now the world's largest copper producer

In its FY25 report, BHP said it was the largest copper producer in the world.

This follows a 28% increase in production over the past three years.

BHP makes this claim based on its copper production data for the 2024 calendar year compared to the publicly reported production of its key competitors in FY24, including Codelco, Anglo American, Antofagasta, Freeport, Glencore, and Rio Tinto Ltd (ASX: RIO).

After several acquisitions, most notably Oz Minerals in 2023, and operational investments, BHP also says it now owns the world's largest copper resource base on a contained metal basis by equity share.

That's a nice position to be in, given BHP expects global copper demand to grow from about 33 Mt today to more than 50 Mt by 2050.

To put this into perspective, BHP produced 2 Mt of copper in FY25.

So, if demand is going to increase by 17 Mt per year over the next 25 years, there is plenty of scope for BHP to grab more market share.

Let's check out the Big Australian's red metal assets.

BHP's copper assets

BHP co-owns (57.5%) and operates the biggest copper mine in the world, Escondida in Chile.

It also owns the Pampa Norte operation in Chile.

Pampa Norte consists of two operations — Spence, which is operational, and Cerro Colorado, which is in care and maintenance.

BHP owns 45% of the Resolution Copper Project in Arizona, US. It's one of the world's largest undeveloped copper projects.

BHP also has a 33.75% stake in the Antamina copper and zinc mine in Peru.

In 2023, BHP bought OZ Minerals, which led to the creation of its BHP Copper South Australia division.

This division bundled BHP's existing Olympic Dam operation with two new operations and an exploratory deposit in South Australia.

The new operations were the Prominent Hill copper-gold mine and the Carrapateena copper-gold mine. The exploratory site was Oak Dam.

In FY25, BHP invested US$2.1 billion to acquire a 50% interest in the Vicuña copper project in Argentina, which is in pre-construction.

The project includes the Filo del Sol deposit, which BHP says is one of the largest greenfield copper discoveries in three decades.

Why invest in copper?

Copper was a major focus for investment in FY25.

BHP allocated US$4.5 billion of its US$9.8 billion capital and investment costs to it.

Copper will play a key role in the green energy transition.

It's essential for the electrification of pretty much everything in our lives, and is also used in green energy infrastructure like wind turbines.

BHP says:

As we move towards a lower carbon future, copper is essential to creating the infrastructure needed for renewable energy sources, such as wind and solar.

We also believe the demand for copper will continue to grow due to grade declines at existing copper mines, the radical urbanisation of large populations in China and India, and the ongoing electrification of energy and transportation.

BHP said it expects to invest about 70% of its medium-term capital expenditure in potash and copper ahead of anticipated higher long-term demand from China as its economy transitions from construction-focused to consumer-focused.

In its FY25 report, BHP commented:

Chinese copper demand was stronger than expected during FY25, with growth in power infrastructure investment and policy support for domestic consumer durables supplemented by a sharp rise in exports of manufactured goods.

BHP shares rise on FY25 report

BHP shares rose by 1.57% on the day the miner released its FY25 report.

This was despite revealing a 26% plummet in underlying profit.

Lower iron ore prices and higher copper prices were a factor in the red metal's 45% contribution to BHP's underlying EBITDA in FY25.

The miner got an average realised price of US$82.13 per wet metric tonne for iron ore, down 19% from FY24.

The average realised copper price was US$4.25 per pound, up 7% on FY24.

Both iron ore and copper production went to record highs in FY25.

BHP produced 263 Mt (attributable) iron ore in FY25, up 1% on FY24.

Copper production exceeded 2 Mt for the first time, coming in at 2,017 kt of copper production, up 8% on FY24.

BHP said Escondida delivered its highest output in 17 years, up 16% on FY24. Spence also reached record production levels.

BHP said its copper production has risen by 28% since FY22.

The EBITDA margins in FY25 were impressive at 63% for iron ore and 59% for copper.

Future of copper

In its FY25 report, BHP said global copper demand is expected to grow from about 33 Mt per year now to more than 50 Mt by 2050.

The company said the key drivers are:

- 'Traditional' economic growth (home building, electrical equipment, and household appliances)

- 'Energy transition' (renewables and electric vehicles)

- 'Digital' (artificial intelligence and data centres).

BHP shares price snapshot

BHP shares have risen by 5% over the past 12 months and 28% over the past five years.