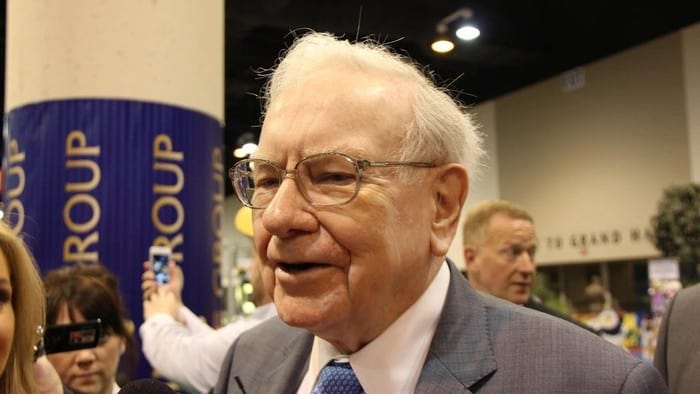

When it comes to investing success, few names carry more weight than Warren Buffett.

Known as the Oracle of Omaha, Buffett has built one of the most remarkable track records in financial history — turning Berkshire Hathaway (NYSE: BRK.B) from a struggling textile business into a global conglomerate worth over US$1 trillion.

But what's most fascinating about Buffett's approach is its simplicity. He doesn't chase hype or swing wildly at speculative bets. Instead, Buffett focuses on high-quality businesses, reasonable prices, and long-term ownership.

The good news? You don't have to live in Nebraska or own a piece of Berkshire Hathaway to apply his principles. In fact, there are several ASX shares that could fit neatly into a Buffett-style portfolio.

What does Warren Buffett look for?

Warren Buffett's investment philosophy has stayed remarkably consistent over the decades. His approach can be summarised by a few key principles.

The first is to buy wonderful businesses at fair prices. Buffett focuses on companies with strong earnings power, proven track records, and reliable growth. He's willing to pay a fair price for a great business — but not an inflated one.

Another principle is to look for economic moats. These are the competitive advantages that help companies fend off rivals and maintain pricing power. They could include brand strength, cost advantages, network effects, or switching costs.

He also urges investors to stick to what they understand. Buffett doesn't invest in businesses he doesn't fully grasp. He calls this his "circle of competence."

And a final key principle is to be patient. Buffett often says his favourite holding period is forever. He prefers businesses that can compound earnings over time.

So how can we apply this to the ASX? Let's find out.

ASX shares that Buffett might like

While Buffett doesn't typically invest in Australia, there are several ASX shares that appear to embody the traits he favours.

One is blood plasma therapies and vaccines leader CSL Ltd (ASX: CSL). It has world class operations, benefits from high barriers to entry and sticky customer relationships, and has strong long-term growth potential.

Another ASX share that the Oracle of Omaha might like is appliance manufacturer Breville Group Ltd (ASX: BRG). Its international expansion, brand strength, and high margins suggest a moat in its own right. It has carved out a premium position in the home appliances space — and like many Buffett favourites, it focuses on consistent execution over flashy disruption.

Finally, Telstra Group Ltd (ASX: TLS) could be an ASX share that ticks boxes for Warren Buffett. It isn't the fastest-growing company on the ASX, but it generates dependable cash flow from a dominant network position and enjoys scale advantages.

The easy way to invest like Warren Buffett

If analysing balance sheets and calculating fair value estimates isn't your idea of fun, there's another way to invest like Warren Buffett — without having to pick individual stocks.

Enter the VanEck Morningstar Wide Moat ETF (ASX: MOAT).

This ASX ETF holds a concentrated portfolio of high-quality US companies that have wide economic moats and are trading at attractive valuations. In short, it does the Buffett-style stock picking for you.

Among its holdings are giants such as Walt Disney, Nike, Estee Lauder, Boeing, and Microsoft.

Foolish takeaway

Investing like Warren Buffett doesn't require a billion-dollar balance sheet. With a focus on quality, patience, and reasonable valuations, everyday investors can adopt his timeless philosophy right here on the ASX.