Many Australian homeowners, businesses, and ASX investors are contemplating the trajectory of interest rates in 2025.

Despite Peter Lynch's iconic quote, "If you spend more than 13 minutes analysing economic and market forecasts, you've wasted 10 minutes", each Reserve Bank of Australia decision produces a ripple throughout the economy, shaping how millions of people spend, save, and invest.

Textbook investing might suggest buying good companies and holding, come hell or high water. But, as we all know, life doesn't exactly operate nicely within the confines of logic. Many of us are faced with the realities of balancing mortgages, daily expenses, and investing for our future — a tightrope act where the weight is distributed depending on interest rates.

Will interest rates be cut in 2025?

The clincher comes down to when interest rates will retreat and by how much.

If you're an ASX investor, chances are you want to invest more in the market. Unfortunately, high interest rates prevent many from stashing away more for their future. According to Finder, the average home loan is now siphoning an extra $1,453 — hitting a total of $3,958 — per month out of Aussie back pockets.

In its final decision before 2025, the RBA kept interest rates on hold at 4.35% yesterday. Reassuringly, the board indicated that the inflationary pressures behind high rates are moving in the right direction, but "risks remain".

What could these risks be?

Data collated by HR software company Employment Hero shows a 5.9% increase in wage growth year on year. This could mean the RBA's desired tightening of consumer spending may take longer as households are able to offset some of the rate pain through pay rises. Likewise, retail confidence is improving.

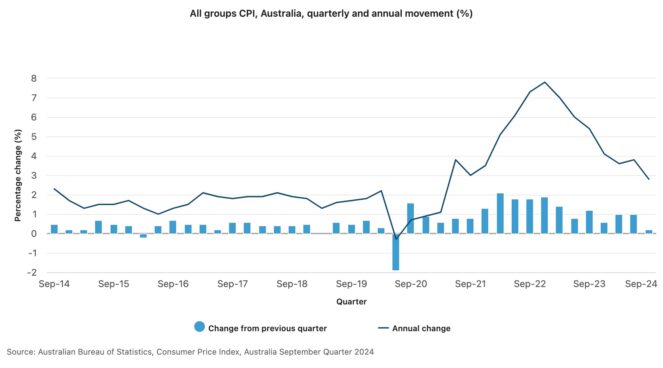

Still, annual inflation is now the lowest it's been since March 2021, as shown above. This is good news for justifying an interest rate cut in 2025. Perhaps the more pressing question is how far into next year can we expect the first cut to occur?

A survey of economists conducted by Finder sheds light on which month the experts are betting on.

Roughly half believe the RBA will first ease rates in May. The next most popular choice is the next RBA meeting in February, as depicted above.

Adelaide Timbrell of ANZ also gave guidance on how much of an interest rate reduction we might see in 2025, telling Finder:

With the economy – notably jobs growth and business conditions continuing to show resilience, we are also shifting our view on the quantum of rate cuts and now expect only two, in May and August 2025. That leaves the terminal cash rate at 3.85%.

Meanwhile, Gareth Aird of the Commonwealth Bank expects the cash rate to be chopped down to 3.35% next year.

What it could mean for an ASX investor

Falling interest rates in 2025 should boost equity portfolios mathematically. The basis for this comes back to some technical calculations involving the discount rate. Theoretically, lower rates make company earnings more valuable to investors.

Another lift can come from cash-heavy investors. As rates decline, money stowed away in savings accounts begins to look lazy. In turn, investors flood back to ASX shares — moving back up the risk curve — in the hunt for better returns.

According to money-managing behemoth BlackRock, large-cap stocks have historically benefitted the most from this shift. Global chief investment officer Tony DeSpirito's research is based on the US market, but a similar response could play out locally.

Specifically, dividend stocks could find renewed interest as rates tick below available dividend yields. For reference, current trailing yields on offer for investors across the 10 largest ASX stocks are as follows:

- Commonwealth Bank of Australia (ASX: CBA) = 3.0%

- BHP Group Ltd (ASX: BHP) = 5.3%

- CSL Ltd (ASX: CSL) = 1.0%

- National Australia Bank Ltd (ASX: NAB) = 4.5%

- Westpac Banking Corp (ASX: WBC) = 4.7%

- ANZ Group Holdings Ltd (ASX: ANZ) = 5.7%

- Macquarie Group Ltd (ASX: MQG) = 2.9%

- Wesfarmers Ltd (ASX: WES) = 2.7%

- Goodman Group (ASX: GMG) = 0.8%

- Fortescue Ltd (ASX: FMG) = 9.7%

It's important to remember, though, that investing in shares is a different beast to cash parked in savings. However, for those willing to take on more risk, the rewards can dampen the impact on a person's passive income machine if interest rates are cut in 2025.