Investors tend to consider ASX 200 bank shares as dividend payers rather than growth investments, with two exceptions — Commonwealth Bank of Australia (ASX: CBA) and Macquarie Group Ltd (ASX: MQG).

And there's good reason for those exceptions, too.

Which bank delivers more capital growth than dividends?

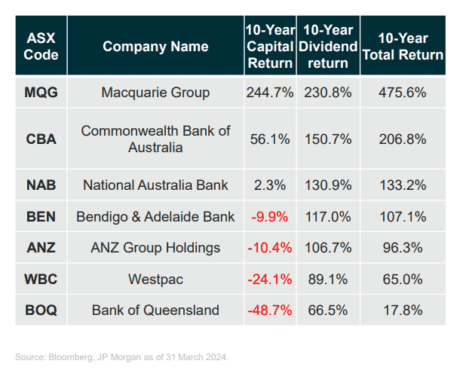

At the recent ASX Investor Day in Sydney, investment strategist Marc Jocum from exchange-traded fund (ETF) provider Global X presented the following data on ASX 200 bank shares.

Source: Global X investor presentation, ASX Investor Day, Sydney

As you can see, Macquarie shares are the only ones that delivered more capital growth than dividend income among ASX 200 bank shares over the decade to 31 March 2024.

The Macquarie share price rose 244.7% and dividend returns were 230.8%, providing a total 10-year return of 475.6%.

When selecting shares for investment, Jocum emphasised the importance of a 'total returns approach' that takes dividend returns into account. This is important because they offset poor growth periods.

According to his presentation:

Most of the largest Australian banks have had negative capital returns. Dividends can add as an important source of returns and help cushion drawdowns.

CBA shares delivered the second-best capital growth, but it was a sliver of Macquarie's at just 56.1% over 10 years. However, a 150.7% dividend return contributed to a solid total 10-year return of 206.8%.

What's happening with ASX 200 bank shares today?

Today, ASX 200 bank shares are lower amid the S&P/ASX 200 Index (ASX: XJO) losing 0.27% in value.

- The Macquarie Group Ltd (ASX: MQG) share price is down 1.11%

- Westpac Banking Corp (ASX: WBC) shares are down 0.79%

- The Bendigo and Adelaide Bank Ltd (ASX: BEN) share price is down 0.32%

- Commonwealth Bank of Australia (ASX: CBA) shares are down 0.27%

- The National Australia Bank Ltd (ASX: NAB) share price is down 0.18%

- The Bank of Queensland Ltd (ASX: BOQ) share price is down 0.17%

- Australia and New Zealand Banking Group Ltd (ASX: ANZ) shares are down 0.035%

Should you buy Macquarie shares?

After Macquarie reported its FY24 full-year results earlier this month, top broker Goldman Sachs retained its neutral rating on the ASX 200 bank share and reduced its 12-month price target to $178.74.

The broker noted that Macquarie's better-than-expected FY24 performance was driven by a lower-than-expected tax rate rather than revenue growth. But it remains optimistic on the ASX 200 bank share.

Goldman said:

Despite this, we remain optimistic on the business's medium term outlook, given i) an improving macro backdrop (we note GS now expects the rate cutting cycle to commence in November), and ii) MQG is well positioned to benefit from the global push towards decarbonisation, further infrastructure investment, and interest rates reaching their peak levels.

Yesterday, Macquarie announced that Fitch Ratings has upgraded the long-term issuer default rating (IDR) of Macquarie Bank Limited.

The long-term ratings of Macquarie entities are now A+ for Macquarie Bank Limited (up from A) and A for Macquarie Group Limited.