Elders Ltd (ASX: ELD) is one ASX All Ords stock performing surprisingly well today, considering its underwhelming FY2024 half-year results.

Ticking past midday, shares in the agribusiness are up 2.1% to $8.39. Meanwhile, the S&P/ASX All Ordinaries Index (ASX: XAO) is a more modest 0.6% higher in Monday afternoon trading.

It's a hard one to rationalise after the downright demolition of company earnings compared to a year ago.

Annualising the company's half-year statutory net profit after tax (NPAT), Elders would trade on a forward price-to-earnings (P/E) ratio of roughly 56 times earnings. The industry average is approximately 17.

So why are investors racing to buy more of this ASX All Ords stock today?

First-half shocker

Today's numbers depict a bleak stretch at Elders for the six months ending 31 March 2024. Here are the key figures from the half-year results:

- Sales revenue down 19% from the prior corresponding period to $1,341.8 million

- Statutory net profit after tax down 76% to $11.6 million

- Underlying return on capital falling from 16.9% to 11.4%

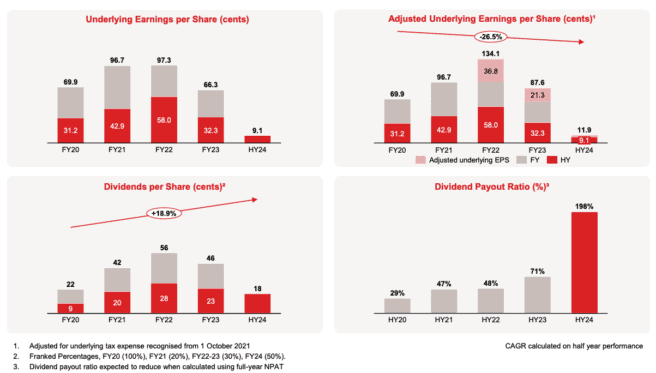

- Underlying earnings per share (EPS) down 72% to 9.1 cents per share

- Total dividends per share down 22% to 18 cents per share (with 50% franking)

The weakness was attributed to four headwinds: challenging seasonal conditions, cautious client sentiment, softening crop input prices, and lower livestock prices.

Unexpected rainfall across eastern and southern Australia provided a boost in the second quarter. However, the recovery in the back half of the six-month period proved inadequate to make up enough ground.

Elders' agricultural chemicals segment experienced the largest half-year decline in gross profits, falling 22.4% year-on-year. Lower crop protection and fertiliser sales were to blame. On a positive note, the company saw volume growth across all its products, suggesting increasing market share.

At the other end of the spectrum, the real estate services side of the business performed strongly, with gross profits increasing 22.5% year-on-year. An improvement in residential turnover and property management fees bolstered the segment.

Still, Elders is outperforming the broader ASX share market today on a massive profit slump. What gives?

What's holding this ASX All Ords stock up today?

Investors might be focusing on future prospects today. Elders presented a possibly redeeming attribute for those with a longer-term view.

The outlook for the full year is more optimistic. Elders expect improved trading conditions in the second half, stemming from a better sentiment. In addition, livestock prices (such as cattle and sheep) are expected to stabilise.

Galvanising the ASX All Ords stock, management reaffirmed their guidance of $120 million to $140 million in underlying earnings before interest and taxes (EBIT) for FY24.

The Elders share price is up 17% versus a year ago.