One ASX stock looks especially buyable as physical money in Australia fights to stay alive.

The increasing adoption of digital and card-based payments has chipped away at cash over the years, but a lethal blow now looks possible. Fears of a collapse in the backbone of Australian money handling have sparked Coles Group Ltd (ASX: COL) to limit withdrawals.

Australian cash in need of life support

In an evolving situation, Armaguard — an Australian cash transporting company owned by Lindsay Fox — is struggling to keep the gears turning of an industry in decline.

Two weeks ago, reports began hitting the headlines that Armaguard was at risk of becoming insolvent. However, the impending issue was highlighted in December last year when the Australian Banking Association prompted Aussie banks to provide input into a sustainable solution for cash.

Lindsay Fox began rattling the can for a cash injection into Armaguard in November 2023.

Today, a $26 million rescue package was offered by the big banks, retail ASX stock Wesfarmers Ltd (ASX: WES), Australia Post, and supermarkets. An offer to keep our plastic pineapples and granny smiths circulating came with an 'end-of-today' deadline.

The deal has since fallen over after Armaguard declined to open its books for due diligence.

Instead, the company is attempting to negotiate its options directly with customers.

Picking an ASX stock to capitalise on a cashless move

Regardless of how this matter works out for Armaguard, the use of cash is collapsing.

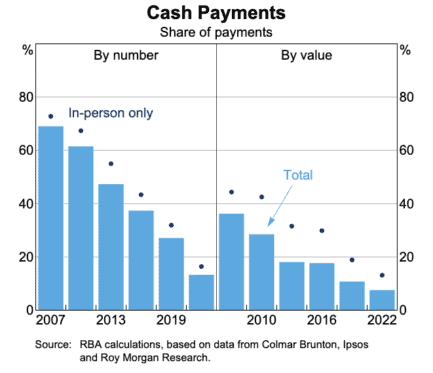

Cash payments made up only 8% of all transaction value in Australia in 2022, as shown below. In 15 years, the physical form of payment has gone from more than a quarter of transactions to less than a tenth.

It's hard to see why the fall in cash use would discontinue. Instead, the odds are digital payment methods will handle more payments if Armaguard decides to make cash more costly for merchants to hold.

As such, I believe Tyro Payments Ltd (ASX: TYR) could be positioned for more growth.

The payment solutions provider continues to grow its revenue and gross profits at solid rates. Tyro clipped the ticket on $22.2 billion worth of transactions through its EFTPOS terminals in the first half, up 83% compared to three years ago.

Additionally, this ASX stock doesn't seem expensive at all. Management is cutting back costs, leaving me to believe that $30 million in net earnings isn't out of reach in a couple of years.

On that basis, I think Tyro Payments could be worth around $1 billion, nearly double its current $540 million market capitalisation. That's if it doesn't get lobbed a takeover bid before then.