In the face of 13 interest rate rises in 18 months over 2022 and 2023, many ASX retail stocks struggled with the expectation that their earnings would drop.

However, there is one direct-to-consumer online retailer that's managed to buck the trend.

Let's check out the phenomenon that's Step One Clothing Ltd (ASX: STP).

Everything that could go wrong

Step One sells men's underwear and rapidly developed a cult following for its bamboo and anti-chafing materials.

Its low-budget television ads also caught the eye of curious consumers and allowed the brand to compete against much larger rivals.

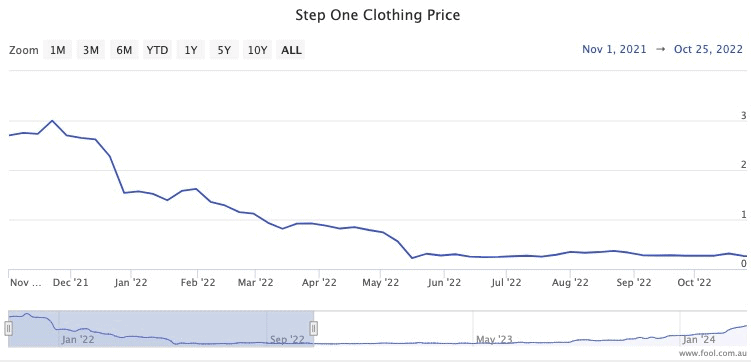

The popularity encouraged the business to float on the ASX in late 2021, in a bull market hungry for initial public offerings (IPOs).

Shares were sold for $1.53 during the IPO, then exploded on the first day of trading, ending up at $2.70.

Unfortunately for all involved, it all came crashing down soon afterwards.

A combination of underwhelming business performance and a market that lost interest in high-growth shares due to rising interest rates meant Step One shares plunged.

By the start of 2023, they were languishing at just 26 cents.

Let's assume you had the foresight to buy $20,000 worth of Step One shares at this point.

A comeback for the ages

As early as January 2023, the experts at Morgans declared that consumer discretionary shares had been oversold.

The team explicitly named Step One as one of the retail stocks to buy.

To the credit of those analysts, Step One shares have gone ballistic ever since.

Over just 14 months, the stock has risen a crazy 569%.

That $20,000 you invested last year? It's now worth $133,846.

Amazingly, Morgans is still backing the $320 million market capitalisation to increase even further, currently maintaining the add rating for Step One.

The moral of this story isn't to speculate all your money into one stock for quick riches.

It's that buying ASX shares when everyone else has fled is not a bad idea, as long as you have faith that the business is capable of recovering in the long run.

If you keep grabbing stocks that are already popular, you will never do better than average. In fact, statistically you would probably do worse than the market.

Good luck out there.