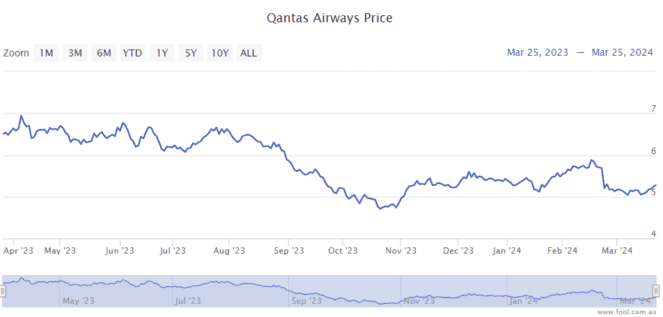

The Qantas Airways Limited (ASX: QAN) share price is still around 20% lower than its high from 2023. Could this be an opportunity to buy the ASX airline share?

A business isn't a buy just because it falls. There may be a completely legitimate reason that the market is now valuing it at a lower level than before.

Qantas is facing several headwinds. Demand doesn't seem to be growing as it was a year or so ago. It has also faced scrutiny related to tickets being sold on cancelled flights, among other issues.

Is the Qantas share price a buy now?

The company recently reported its FY24 first-half result. Underlying profit before tax was down 13% to $1.25 billion and statutory net profit after tax (NPAT) declined 13% to $869 million. It said it had net debt of $4 billion and announced an additional on-market share buyback of up to $400 million.

Broker UBS said the reported numbers missed its estimates, though they met the market consensus expectations. Revenue and fuel were better than UBS had expected, but other costs were higher.

Qantas management still think the airline can achieve more scale benefits, transition costs dropping out and ongoing transformation to fight inflation.

The broker thinks there is enough momentum on costs, fuel and demand for a slightly stronger second half.

However, UBS also acknowledged that a loyalty change is coming that, in Qantas' words, "will represent a significant investment for members". The UBS team thinks this will benefit members at a cost to shareholders.

After considering all of that, UBS thinks the Qantas share price is a buy, with a price target of $7.55, implying a possible 40% rise over the next 12 months. That would be a strong result if achieved.

Undervalued?

UBS thinks Qantas can sustain earnings near its FY23 result, where earnings per share (EPS) was 96 cents per share. It thinks Qantas' earnings will have a "more durable composition" with more capacity, lower fares and higher loyalty.

The broker is conscious of growing capital expenditure demands, which could stall medium-term growth because of higher depreciation, amortisation and interest costs.

UBS thinks a fair profit multiple for Qantas is 8.2 times compared to the long-term average of between 9 times to 10 times. Based on the FY25 estimate of 93 cents per share, the Qantas share price is valued at 5.8 times FY25's projected profit.

If UBS is right, Qantas shares could be an appealing opportunity, but they certainly come with risks and issues. However, keep in mind that's seemingly why the Qantas share price is where it is today.