The S&P/ASX 200 Index (ASX: XJO) has now risen more than 15% since the start of November.

This means it's getting harder to find bargains among the overpriced traps.

To assist in your hunt, here's a couple of suggestions from Catapult Wealth general manager Dylan Evans:

'Appealing valuation' for this ASX 200 stock

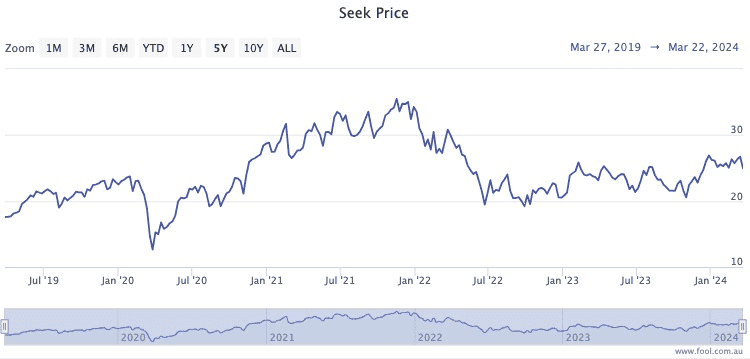

The Seek Ltd (ASX: SEK) stock price is still almost 28% down from its peak before the inflation sell-off of growth shares over 2022.

Evans feels like the international online jobs classifieds operator is ready to break out in the coming period.

"Seek has invested in technology improvements during the past few years, so the benefits should flow through in the next two to three years," Evans told The Bull.

This is despite the first-half results failing to impress the market last month.

Australia and New Zealand paid job listings were down 20% and consequently adjusted net profits after tax (NPAT) from continuing operations plunged 24%.

Seek chief executive Ian Narev, however, also pointed out that its tech upgrade spend was now behind it.

"The highlight of this period was the delivery, ahead of time, of the unified product and technology platform that will provide the foundation of our future growth," he said.

"We can now turn our focus from… project management to realisation of the significant benefits that the platform can deliver: faster innovation and economies of scale."

Seek now has nine out of 15 analysts surveyed on CMC Invest rating it as a buy.

The stock looks cheap to Evans.

"We're attracted by potentially strong growth and an appealing valuation compared to peers."

Recycling and acquisitions

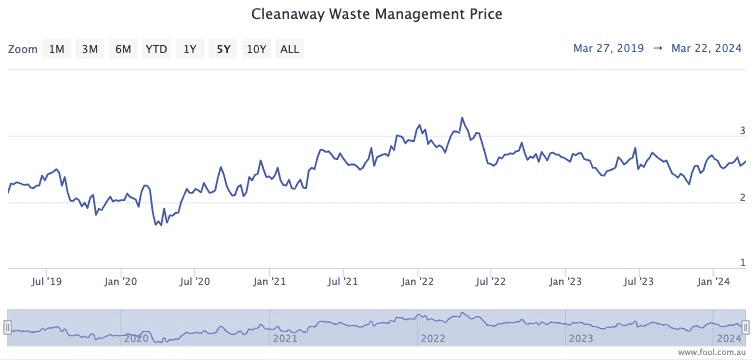

As a waste management company, Cleanaway Waste Management Ltd (ASX: CWY) is in an industry that will never want for demand.

Evans admits it's unlikely to display any explosive growth, but in return offers stability in a diversified portfolio.

"Cleanaway is a leader in the waste and recycling industry, which offers defensive cash flows and reasonable growth."

The big opportunity in the future is recycling.

"It should generate growth as it expands into resource recovery, supported by a national goal to increase recycling rates from 60% to 80% by 2030."

As a dominant player in the sector, there is also potential for mergers and acquisitions.

"We see an opportunity for Cleanaway to improve profitability on the back of industry consolidation."

Seven of 13 analysts rate Cleanaway shares as a buy, according to CMC Invest.