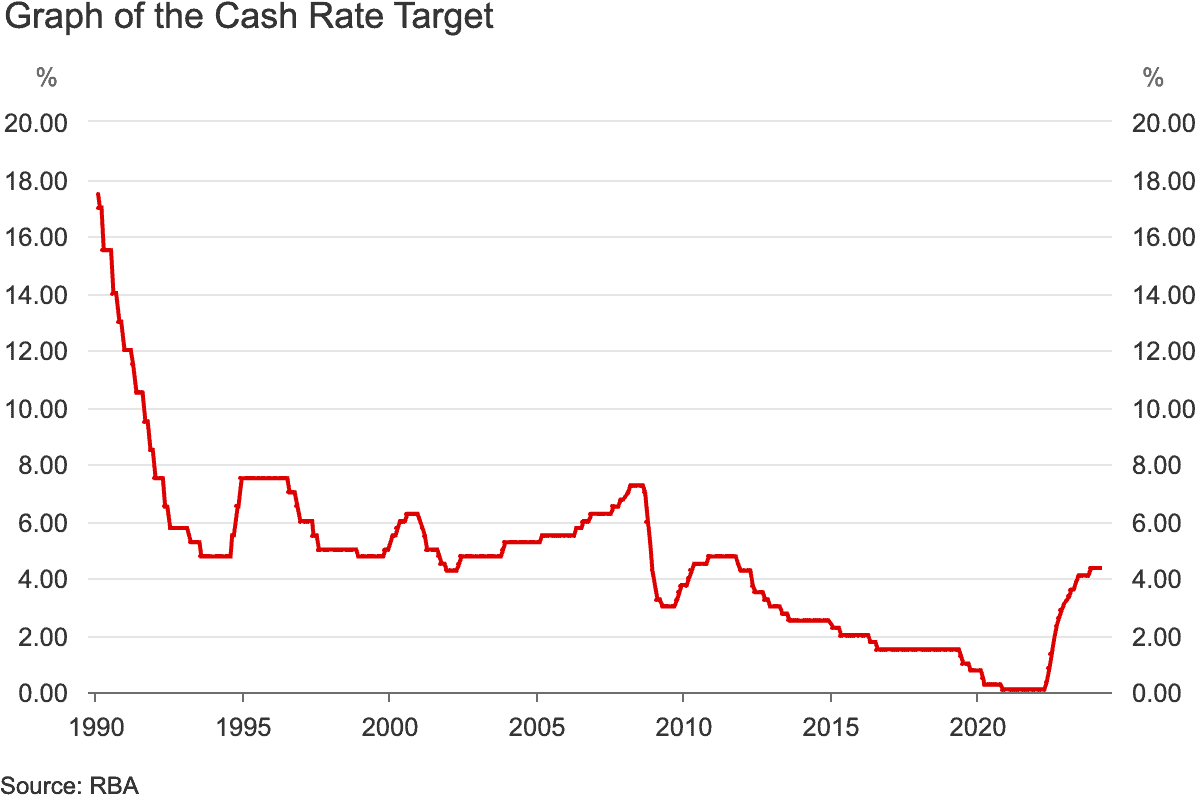

Oh my God, how much are we all looking forward to some interest rate relief?

COVID-19 disrupted our lives in many ways that may never be repeated again, and 12 rate rises in 13 months was one of the consequences.

It was 13 hikes in 18 months, if you include the last increase in November.

The Reserve Bank had no choice, as inflation was out of control after the pandemic fattened up people's savings and disrupted supply chains.

But now that part of the cycle seems to be nearing the end, mortgage holders, businesses and stock investors alike are pumped for the next interest rate movement to be downward.

And whenever that happens, I reckon these four ASX growth shares will cash in:

Institutional investors could be jumping onto this ASX growth stock

The fortunes of the mining industry is closely tied to how well the economy is doing.

That's because the demand for raw materials heads up as consumers spend more, then that pushes up commodity prices and the valuations of miners.

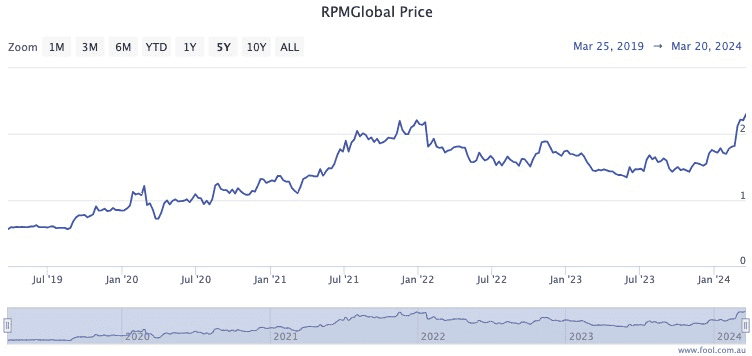

An excellent way to gain exposure to that upside is RPMGlobal Holdings Ltd (ASX: RUL), which provides technology and related services to mining businesses.

The tech stock is the Forager Australian Shares Fund's largest holding, with the team pleased with how reporting season went.

"Revenue was up 21% and earnings before interest and tax more than tripled, thanks to a relatively fixed cost base," it stated in a report to clients.

"We expect revenue to continue growing for a long while yet and profit to keep growing faster."

A bonus up the sleeve is that the small cap is now approaching critical mass.

"The company now has a $500 million market capitalisation and trading volumes in its shares have increased markedly over the past month, making it potentially appealing to a wider range of institutional investors."

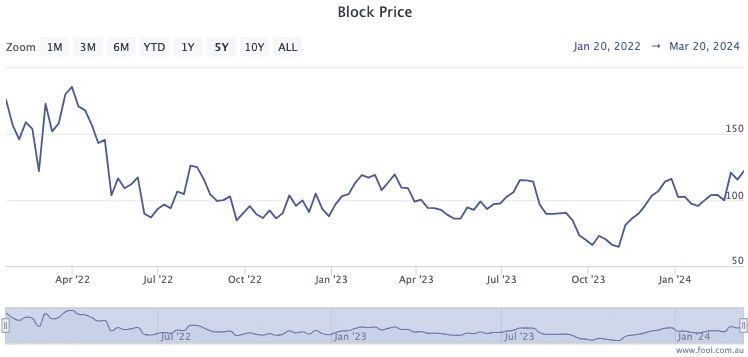

The prototypical ASX growth stock

Fintech Block Inc CDI (ASX: SQ2) is very much a stereotype of a stock that is heavily dependent on interest rates for its outlook.

It's a high-growth US tech company, it services the rate-sensitive industry of consumer finance, and it has investments in cryptocurrency, especially Bitcoin (CRYPTO: BTC).

Not only will it enjoy a huge boost when interest rates come down, it will benefit from being a more efficient business after its efforts to cut costs over the past couple of years.

And Jay-Z owns Block Inc shares. How can you go wrong?

Three of five analysts currently surveyed on CMC Invest rate this ASX growth stock as a strong buy.

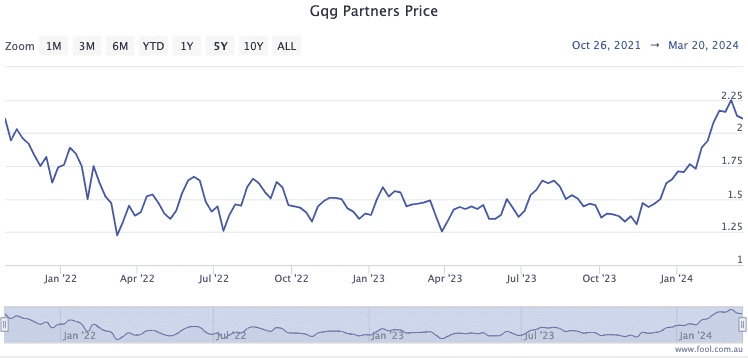

Another Yankee on the ASX looking good

GQG Partners Inc (ASX: GQG) is an American investment outfit that manages active stock portfolios.

So it's no surprise that these ASX growth shares move up and down roughly corresponding to the fortunes of the general share market.

Therefore, when interest rates are brought down it could be in for a surge push upwards.

ECP is one of many investment houses that are bullish on the outlook for GQG Partners shares.

"GQG's business continues to perform to expectations, with consistent positive monthly net flows from higher fee channels and strong fund performance across all products on a rolling three-year time-frame," ECP analysts said in a recent memo to clients.

"This consistent alpha generation gives us confidence GQG can continue to sustain flows as it moves toward utilising its significant fund capacity."

Incredibly, the GQG share price has rocketed more than 52% over the past six months.

Cheaper than its peers

I mentioned earlier that commodity prices are correlated to the health of the economy.

Even among minerals, this is the most true of iron ore.

It is a basic raw material needed for construction, which is one of the primary industries that rise or sink with consumer demand.

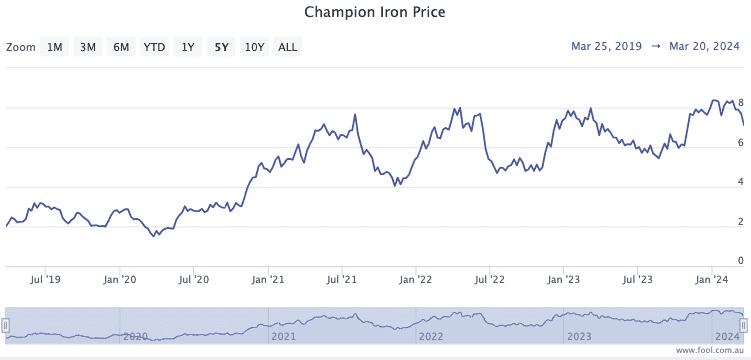

And among iron ore miners, Champion Iron Ltd (ASX: CIA) is looking bullish.

CMC Invest currently shows six out of seven analysts rating the stock as a buy.

"We remain bullish regarding the outlook for iron ore in 2024," said Fairmont Equities managing director Michael Gable a few weeks ago.

"This Canadian based producer is trading on valuations which compare favourably to its peers."