Everyone remembers their first time.

If you have never done it before, buying ASX shares can be a scary experience.

You don't know whether you will lose money. You feel like you don't have as much knowledge as the veterans. You're concerned about being "fleeced".

However, it's a lot easier to get started now than it used to be.

Back in the days when you had to buy stocks through a human broker on the telephone, investors often needed to put in a decent whack of money to make the brokerage fees worthwhile.

These days, with the advent of online broking platforms, just $1,000 can get your portfolio started.

So if I were starting now, what would I buy?

An easy way to begin for a new investor

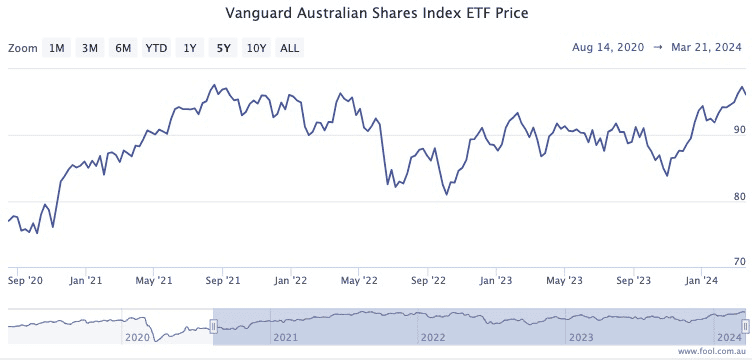

A great place to start is index exchange-traded funds (ETFs).

Buying an ETF stock provides the beginner with instant diversification and all the risk management benefits that comes with it.

And in modern times there are indices for every investment angle, so it's not hard to find something that suits your tastes and judgments.

ETF shares also save a lot of time and effort for novices, as they don't need to be constantly following the news on particular companies to decide whether to buy or sell. The index, and therefore the fund, will automatically do that on their behalf.

But — and you know it was coming — there is a catch.

What index ETFs can't give you

The limitation of index funds is that it will never perform better than the market. That's the trade-off one makes for the convenience it brings.

Actively picking ASX shares is the only way an investor has a chance to do better than the average.

And while that might be daunting to the first-timer, there are plenty of quality choices on the ASX to choose from.

They need not be speculative. If you are convinced that the business will be in better shape in five years' time than how it is now, you have a buy candidate.

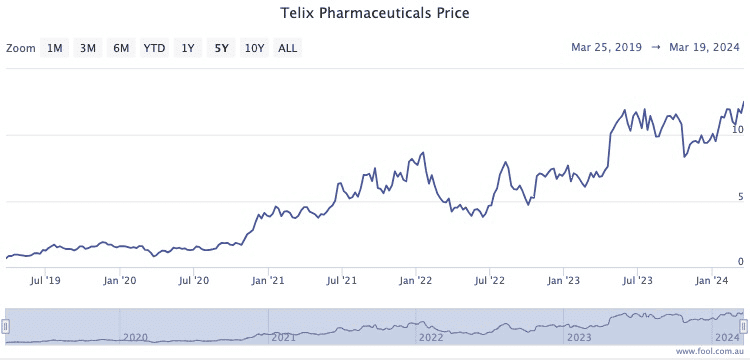

Take three of my current favourites at the moment — Xero Ltd (ASX: XRO), Johns Lyng Group Ltd (ASX: JLG) and Telix Pharmaceuticals Ltd (ASX: TLX).

They are in vastly different industries — software, construction and healthcare — but are all quality companies with an excellent track record of growing value for shareholders.

The past five years has seen their share prices return 171%, 386%, and 1,900% respectively.

No index fund could even come close to that sort of performance.

Of course, not every stock you pick will do that well. But if the portfolio is properly diversified, these types of winners can make up for the losers, plus more.