Many Australians don't realise that the power of compounding means that with just $15,000 worth of ASX shares it's possible to generate thousands of dollars of passive income.

Let's take a look at how this can be achieved, using the popular dividend stock Accent Group Ltd (ASX: AX1).

An excellent dividend payer

Accent Group shares currently pay out a dividend yield of around 7% at the moment, which is fully franked.

Imagine that you bought $15,000 worth of the stock.

While past performance is never an indicator of the future, we'll use history to demonstrate hypothetically what could happen.

Assume there will be no capital gain and that a 7% yield will be the only source of returns.

That is a conservative estimate as the footwear and fashion retailer has shown a decent capability to increase its share price over the long run.

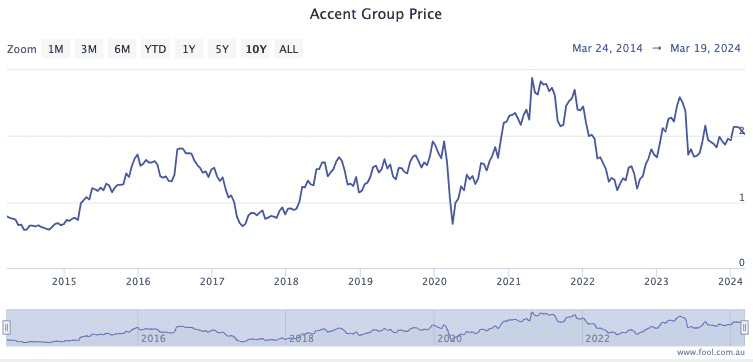

For example, the Accent stock price has risen 146% over the past decade.

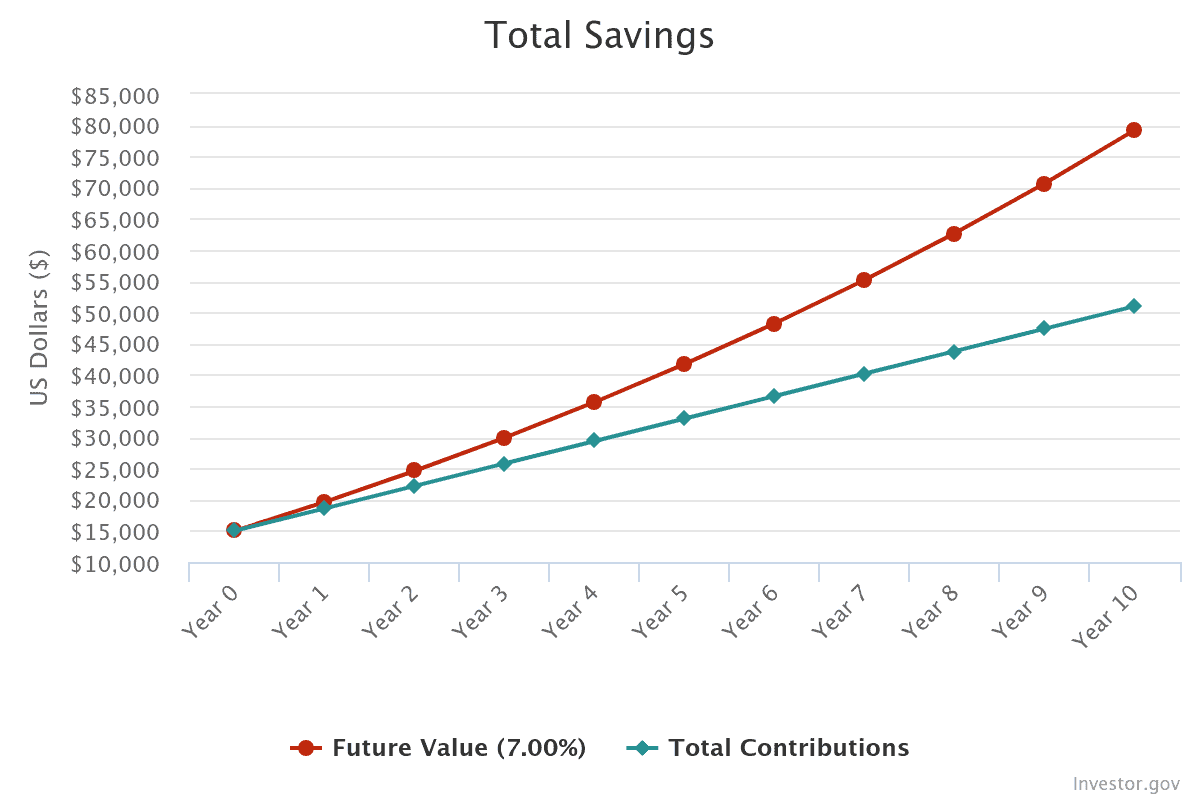

Anyway, if that $15,000 grows at 7% while you're able to save and add $300 to it each month, you're on your way.

After 10 years with Accent stock

After 10 years of that investment regime, your Accent shares will be worth $79,246.

From the 11th year, stop investing the dividend and try pocketing it.

That's an average passive income of $5,547 each year!

That's an overseas holiday each year paid for without lifting a finger.

Now, in real life you would want to diversify your portfolio and not just put it all on Accent Group.

That way, if anything goes horribly wrong for the retailer, you could be saved by other investments that have done a lot better.

Also, realistically, the Accent Group share price could rise over the long run, providing annual returns higher than 7%.

In that case, you could reach $5,500 of passive income much faster.

That's a lot of numbers to think about, I know. But if it means you start investing and make your money work for you, it's worth thinking about.