Often the dilemma with stocks that have very high dividend yields is that there could be concerns about the business outlook.

But just occasionally you come across an ASX stock that's fallen in price, making it cheap and supercharging the dividend yield, but has a bright future ahead.

It's that rare find that's in the sweet spot.

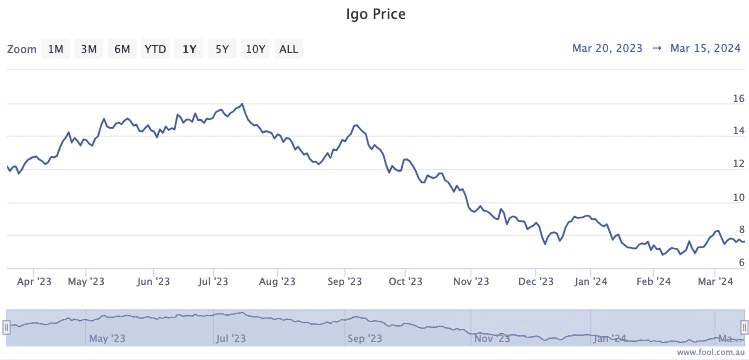

Multi-mineral producer IGO Ltd (ASX: IGO) has seen its share price tumble more than 53% since July.

As a consequence, its yield now stands at a mouthwatering 9.6%.

Is this a trap or have we found the end of the rainbow?

Why has this dividend stock struggled?

Although IGO has a record of extracting nickel, copper, and cobalt, its market fortunes are overwhelmingly dominated by the headline-grabbing lithium business.

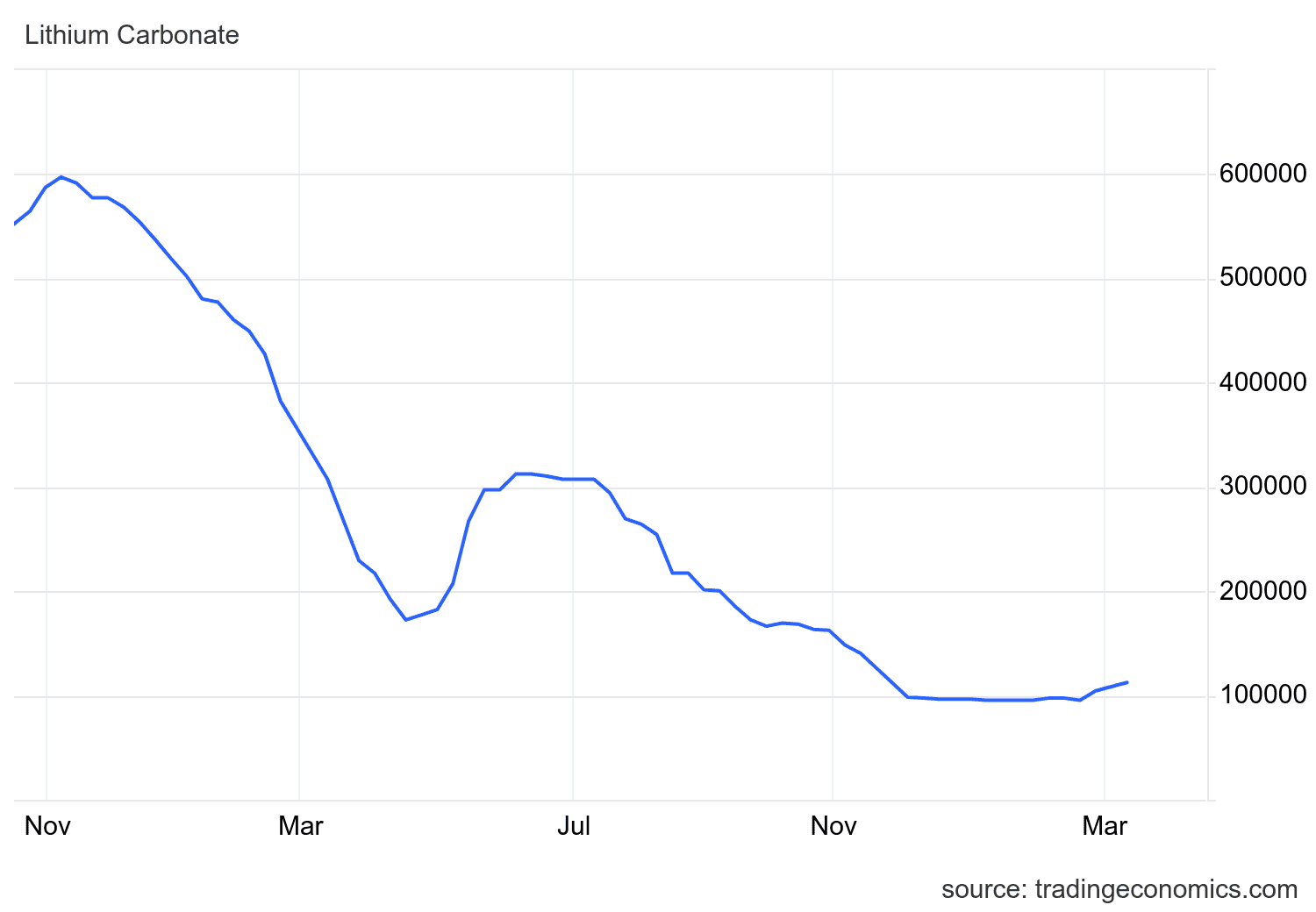

And global lithium prices have plummeted.

In November 2022, a tonne of lithium carbonate was fetching almost 600,000 CNY. Just 16 months later, you'd be lucky to sell it for 113,000 CNY.

The problem has been that China's consumers are locking up their wallets, dampening demand for electric cars in that country.

Western markets have not helped either, with billions of consumers crushed by inflation-busting interest rate rises.

So that's the bad news.

Has IGO bottomed now?

Now for the good news.

Lithium demand, in the long run, is expected to be strong.

In the coming years the world will need many new batteries to cope with the electrification of millions of engines that used to run on fossil fuels.

It's not just about nations altruistically reducing their carbon footprint. Recent wars in Europe and the Middle East have reminded all and sundry that depending entirely on imported oil and gas is a risky move.

IGO Ltd, as one of the smaller miners, has done well to keep production going. Some other players, such as Core Lithium Ltd (ASX: CXO) have been forced to stop because producing lithium has become uneconomical.

Just last month the team at Blackwattle picked IGO as the lithium stock to buy for those wanting to get into lithium for cheap right now.

"We believe IGO provides investors with exposure to the best lithium mine in the world, Greenbushes, which is producing at a cost still well below current weak spodumene prices."

And many of their peers agree.

According to broking platform CMC Invest, nine out of 18 analysts are recommending IGO as a buy right now.

So yes, this could be a rare time that a falling stock with a high dividend could be a wise buy.