Another ASX reporting season has come to an end. For some companies, February marked a celebratory event; for others, it was a sobering experience — making it a season of ASX winners and losers.

The general consensus among analysts is that results were, on average, better-than-expected. After all, many had speculated in the lead-up to February that this would be the set of figures that finally reflected cost inflation and a softening economy.

Still, not all roads led to Rome. Let's look at some Aussie companies that rose to the occasion and some that faltered.

Who are the winners of this ASX reporting season?

Arguably the standout sector of the month was ASX retail shares. Fears of corporate earnings feeling the sting of a spending-conscious consumer had set expectations. Investors were anticipating steep falls in revenue and profits as discretionary spending came under scrutiny of more households.

While some shoppers did dial back somewhat amid greater wallet strain, the reduction was not as dire as investors had prepared themselves for.

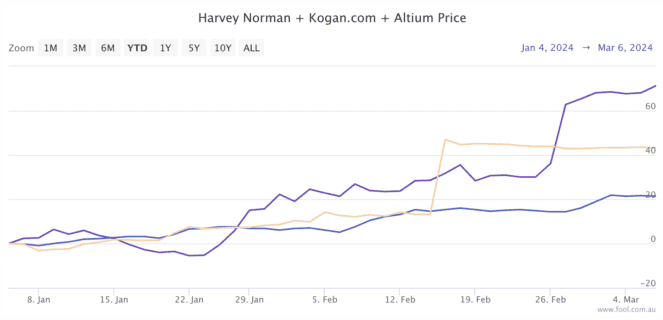

For example, Harvey Norman Holdings Limited (ASX: HVN) and Kogan.com Ltd (ASX: KGN) reported sales declines of 6.8% and 5.6%, respectively. However, the share prices of these two companies rallied 4.4% and 23.7% on their results.

In the case of Kogan, investors were thrilled with the company achieving a net profit after tax (NPAT) of $10.2 million after netting a $9.6 million loss in the previous first half — fitting for an ASX winner. Meanwhile, investors were willing to forgive Harvey Norman for its 29.4% fall in pre-tax profits.

Another February earnings season ASX winner was chip design software seller Altium Ltd (ASX: ALU), although you wouldn't think so based on the price move on results day.

Altium shares retreated 0.1% to $65.05 after handing its first-half figures to the market on 27 February. However, this company's 'winning' part of reporting season arrived as a takeover offer before its results were posted.

Nevertheless, Altium's results were still impressive. Revenue jumped 15.9%, and net profits grew 11.4% for the six months ended 31 December 2023.

The lemons

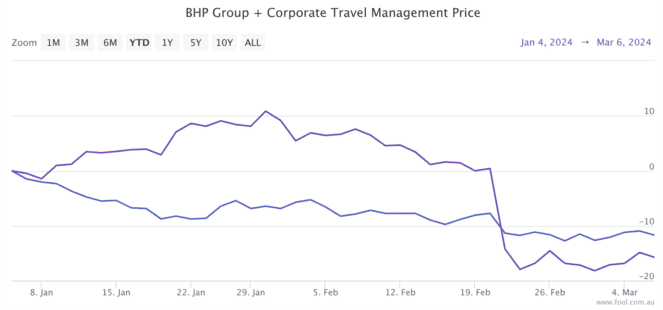

Earnings among the top 200 ASX companies fell 35% in aggregate, meaning there were some real doozies during the month.

One of the most notable Australian companies taking a deep cut to its earnings was mining behemoth BHP Group Ltd (ASX: BHP). Despite its underlying earnings holding steady at US$6.6 billion thanks to iron ore and copper prices, nickel became BHP's problem child in the half.

The mining giant incurred a US$2.5 billion impairment on its Western Australia Nickel asset. On top of that, another US$3.2 billion charge was booked related to the dam failure at Brazil Samarco several years ago.

Shifting gears, another company that possibly would have been on the ASX winners list if not for its weaker guidance was Corporate Travel Management Ltd (ASX: CTD). Despite posting revenue and NPAT gains of 25% and 222%, the travel operator sustained a 20% hit to its share price.