Some investors think buying ASX shares that have risen is crazy talk because the "gains have already been made".

But that's spurious logic, for at least two reasons.

First is that stocks have no memory. They don't care whether they have risen or fallen. Only the future prospects matter.

Second is that if a stock already has upward momentum it means many others think the business is heading in the right direction. The whole point of investing is to own shares that other people want.

So now that we've set that record straight, let's take a look at two ASX shares creeping up at the moment that experts are naming as buys:

Starting 'a new uptrend'

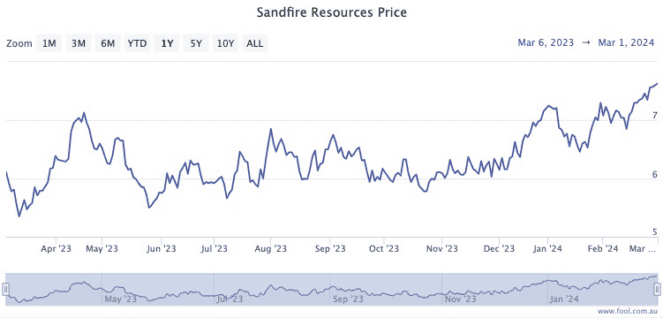

Sandfire Resources Ltd (ASX: SFR) shares have soared 33% since late October.

And Fairmont Equities boss Michael Gable reckons there's more where that came from.

"Sandfire Resources is the largest pure-play copper producer on the ASX," Gable told The Bull.

"We remain positive about the prospects for copper as we expect lower supplies and sustained global demand to result in higher prices during the next few years."

Many of his peers agree. According to broking platform CMC Invest, 10 out of 18 analysts are rating Sandfire as a buy right now.

"The stock is now starting to break above a three-year resistance level on the chart, so we believe it's likely to start a new uptrend."

The ASX shares up 30% in 4 months

Similar to Sandfire, Hub24 Ltd (ASX: HUB) shares have rocketed 30% since the start of November.

The investment platform provider is still a buy for Marcus Today equity analyst Matthew Lattin.

"Hub24's first half results in fiscal year 2024 saw notable increases in key metrics," he said.

"Group underlying EBITDA of $55 million was up 10% on the prior corresponding period and statutory net profit after tax of $21.5 million was up 39%."

The best metric though, is that investors are pouring money into the platform.

"Record half year net inflows of $7.2 billion – an increase of 26% – demonstrates strong demand for its platform services.

"Moreover, Hub24's strong pipeline of existing and potentially new advisers suggests promising growth prospects."