I love finding ASX dividend shares with big dividend yields. I think some businesses are undervalued, which means they could deliver good share price returns and pleasing passive income.

It's a difficult retail landscape at the moment, with so many households facing inflation pressures. But, I don't believe the economic environment forever will be tricky forever, meaning this could be the right time to look at beaten-up ideas.

If the share prices of the two cheap ASX dividend shares below have been oversold, the future dividend yields could be huge.

Universal Store Holdings Ltd (ASX: UNI)

Universal Store owns a number of "premium" youth fashion brands. Its businesses and brands include Universal Store, THRILLS, Worship and Perfect Stranger. The company currently operates 100 stores across Australia, and this number is steadily increasing.

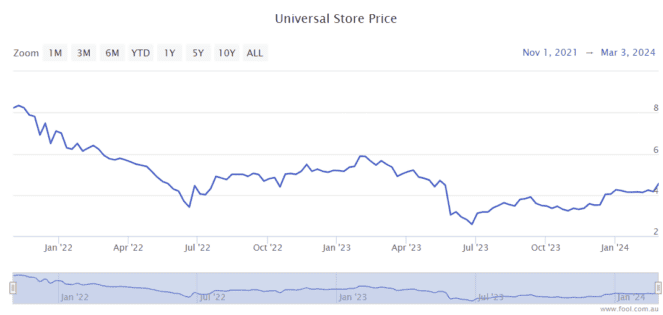

The Universal Store share price is still 45% lower than it was in November 2021, which has boosted the dividend yield.

The company has grown its annual dividend each year since 2021, when it first started paying dividends.

In the FY24 first-half results, the company advised it grew its total sales by 8.5%, underlying earnings before interest and tax (EBIT) rose 8.1% to $30.8 million and statutory net profit after tax (NPAT) rose 16.7% to $20.7 million. It grew its interim dividend 17.8% to 16.5 cents per share.

I think the cheap ASX dividend share can keep boosting its store count, particularly the number of Perfect Stranger stores, to help grow profit over time.

According to the projection on Commsec, Universal Store could pay a grossed-up dividend yield of 7.7% in FY24 and 9.7% in FY26.

KMD Brands Ltd (ASX: KMD)

KMD Brands is another ASX retail share related to apparel. It has three brands – Kathmandu, Rip Curl and Oboz.

The KMD share price is down close to 70% from October 2021.

The company is seeing weak consumer sentiment, while the warmest winter on record in Australia has hurt Kathmandu sales. KMD expects to see signs of improvement in the second half of FY24, and in FY25.

The Rip Curl and Oboz brands have suffered from a sizeable reduction in wholesale sales as wholesale clients reduce inventory holdings. However, KMD Brands expects FY25 to have a positive outlook for the wholesale channel.

I think this company can bounce back in the medum-term – it's working hard on improving sales, optimising its gross margin, controlling operating costs and reducing working capital. The very large fall of the KMD Brands share price gives us plenty of margin of safety, in my opinion, when we think about when the company might achieve in FY25 and FY26.

According to the projections on Commsec, the cheap ASX dividend share is valued at 10x FY25's estimated earnings and 6x FY26's estimated earnings.

With that profit generation, KMD Brands could pay a dividend yield of 7.4% in FY25 and 10.7% in FY26.

However, keep in mind that the FY24 dividend yield – the current financial year — could be minimal. It's currently estimated at 4.9%, though I'd warn it could be less than that (or possibly even nothing), depending on what the board decide.