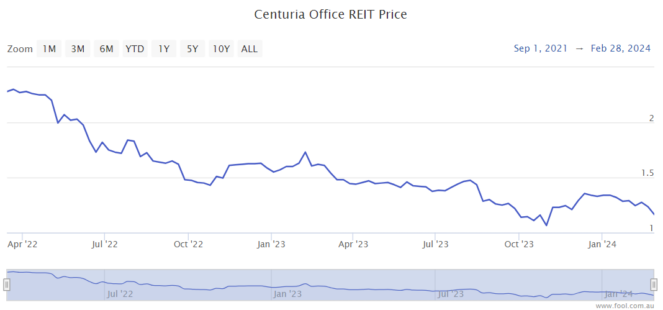

The Centuria Office REIT (ASX: COF) share price has fallen more than 50% since September 2021. As it trades near all-time lows, I think the ASX dividend stock is an underrated buy.

Centuria Office REIT, as the name suggests, is a real estate investment trust (REIT) that owns office properties. It is managed by the fund manager Centuria Capital Group (ASX: CNI).

It's understandable why the market has sent the REIT's valuation down by double-digits in percentage terms. The flow-on effects of the COVID-19 pandemic include a rise in employees working from home and a reduction in people working in offices.

Interest rates have also increased, which should mean an increase in debt/interest costs over time, and it also pushes down on the valuation of assets.

However, there are a number of reasons why I think this is the right time to look at the ASX dividend stock.

Big dividend yield

The business' valuation has fallen so much that it has pushed up the distribution yield to a level that can provide strong cash returns, even if the share price remains in the doldrums for some time.

Centuria Office REIT pays quarterly, so investors are getting the annual payout in a regular manner.

Using the projection on Commsec, the REIT is expected to pay an annual distribution per unit of around 12 cents for FY24, FY25 and FY26. This translates into a forward distribution yield of just over 10% for the current financial year and the two subsequent years.

Strong portfolio metrics for the ASX dividend stock

The business can't control what's going on with real estate values, but I think the Centuria Office REIT share price decline more than makes up for the likely decline of the property valuations.

At December 2023, the business said it had net tangible assets (NTA) of $1.98 per unit.

It's hard to say exactly what the properties are worth right now, but the distribution yield and other portfolio metrics still look good.

As of December 2023, it had portfolio occupancy of 96.2% and a weighted average lease expiry (WALE) of 4.4 years. Almost 80% of the rental income is derived from government, multinational businesses or listed businesses – in other words, these are strong tenants. I also believe they will likely continue to need office space for the foreseeable future.

Geographic diversification

The business does not just own Sydney and Melbourne CBD office buildings – the entire states of Victoria and NSW make up less than half of its total portfolio. Plus, with those Melbourne and Sydney market investments, it has good exposure to the fringes where there has been an increase of tenants increasing their footprint.

I think this geographic diversification gives the REIT a good chance of it avoiding significantly bad falls for its overall portfolio.

Bonus reason

Even if the ASX dividend stock were to see an ongoing decline in tenant demand across the board for office space, there's always the potential for it to change those office buildings to residential use, which could unlock stronger rental potential in the future.