The materials sector has been a weak spot within the Australian share market during 2024 so far. Dragging the sector down nearly 11% year-to-date, many ASX mining shares have succumbed to softening commodity prices.

Still, the entire sector cannot be painted with one brush. Each commodity faces its own set of conditions impacting supply and demand, and thus its price.

For example, the price of lithium has wilted away amid a softening appetite for EVs. In contrast, energy-dense uranium has flown to new heights as nuclear energy finds a growing place in the energy transition. This is evidence of how different commodities — and their associated ASX mining shares — can perform in dissimilar ways.

So, what are experts heralding as the next outcast and outperformer in the ASX mining sector?

Bleak outlook for an industry on life support

When mines are getting shuttered and companies are chasing government assistance, it's usually a fair sign that the situation is not good.

Australia once held the title of fifth-largest nickel producer in the world two short years ago. But those were different times. A time when the battery metal reached US$48,000 per tonne. That price is now a distant memory in 2024, with nickel fetching US$17,000 per tonne today.

The culprit? Indonesia ramped up nickel production to an enormous 1.8 million tonnes last year — accounting for half the world's nickel supply. Not only is there a lot more nickel on the market from Indonesia, but it's also at a price that others are incapable of achieving.

In turn, BHP Group Ltd (ASX: BHP) had to write down the value of its nickel assets on 15 February. An unnerving US$2.5 billion was erased from the carrying value of the company's nickel assets in Western Australia.

According to Sam Berridge of Perennial Funds Management, these troubling conditions could continue. The portfolio manager expects the flood of cheap supply to continue, noting a real concern that nickel prices could be at risk amid new battery chemistries that do not contain nickel.

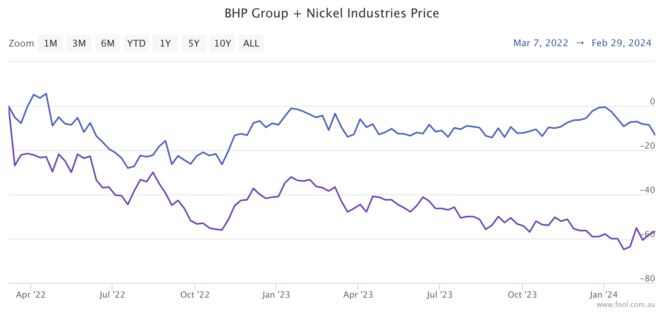

Although a diversified materials miner, BHP Group has seen its share price weaken 13% since the high nickel prices in 2022. Meanwhile, despite operating in Indonesia, Nickel Industries Limited (ASX: NIC) has suffered a 57% fall in its share price.

Nickel Industries reported record gross profits today for FY23. However, net profit after tax (NPAT) declined 16% to $176.2 million.

Which ASX mining sector could prosper?

It's not all dark clouds in the Aussie mining sector. Another metal that is critical in the electrification trend is copper. Analysts believe the conductive metal won't need to weather an oversupply like nickel anytime soon.

Ben Cleary of Tribeca expects copper to be in a supply deficit for most of the decade citing costs as a deterrent from new supply.

In addition, much of the world's supply is centred in Chile and Peru. These jurisdictions are susceptible to interruptions. For instance, 600,000 tonnes of copper production was canned last year between strikes at the Las Bambas mine and a government-enforced closure of the Cobre Panama mine.

Another commodity expert, Daniel Hynes of ANZ, reckons US$10,000 per tonne of copper is on the cards this year. Currently, a tonne of copper goes for US$8,474, suggesting an 18% upside.

ASX mining companies with copper exposure include BHP, Rio Tinto Ltd (ASX: RIO), Sandfire Resources Ltd (ASX: SFR), and 29Metals Ltd (ASX: 29M).