Although what's defined as "cheap shares" is often in the eye of the beholder, there are some common characteristics investors can look for.

The biggest one is if a business is in a cyclical industry and is temporarily out of favour with investors. If there's certainty that eventually the good times will roll around, then there's a decent argument that the shares are inexpensive.

Another is if the stock is suffering from a one-off shock. If you can decipher that in the long run the adverse impact will be negligible on the company, then the shares could be great value.

Perhaps a more unusual scenario might be that the business could be ripe for a takeover or merger. The industry could be experiencing a period of consolidation.

Having thought about these factors, here is a pair of cheap shares that I think are worth considering at the moment:

Market spooked, but the pros aren't

Camplify Holdings Ltd (ASX: CHL) shares had a bit of a shock recently.

Its contribution to the ASX reporting season last Wednesday saw the stock plunge 17% that day.

But this could be one where investors could now buy up these shares at a terrific price because the anxiety the market is feeling may well be temporary.

All three of Canaccord, Morgans, and Ord Minnett have retained their strong buy ratings, according to broking platform CMC Invest.

The day after the half-year result, Morgans explained why it disagreed with the market's pessimism:

"The stock closed down ~17% on result day, which we largely attribute to some seasonality in Camplify's key headline metrics — future bookings, gross margins, etc.

"We make several cost and margin assumption changes over the forecast period. Our price target remains unchanged and we maintain an 'add' recommendation on the stock."

'Fundamentally undervalued' cheap shares

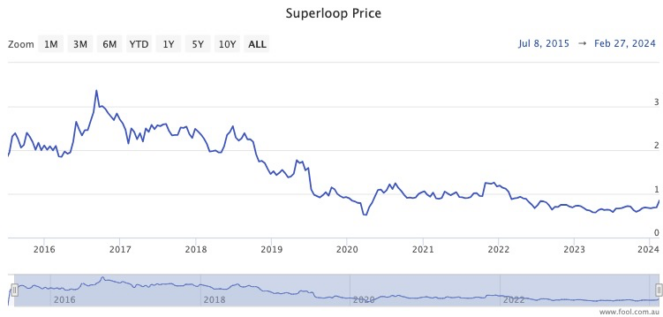

Internet services provider Superloop Ltd (ASX: SLC) has been on the ASX for nine years, not doing a great deal for its poor shareholders.

The stock was sold at $1 during its initial public offering (IPO) in 2015, but it has rarely exceeded that level since first dipping under it in July 2019.

The shares were slogging it out at 87 cents when the market closed last week.

Then some furious developments over the weekend changed everything.

On Monday morning, boom rival Aussie Broadband Ltd (ASX: ABB) revealed that not only had it taken a 19.9% stake in Superloop, but it wanted to buy the whole thing for 95 cents a share.

By the end of the day the Superloop board had rejected the offer, labelling it "opportunistic" and insisting the price "fundamentally undervalues" the company.

With a warmly received half-year report behind it, Superloop and its investors seem to be confident that the outlook is brighter than what Aussie Broadband is costing it at.

Microequities chief Carlos Gil told the Financial Review that the offer was an insult.

"It's very, very far from what we consider to be fair value," he said.

"We're very confused as to how they think they could possibly acquire it at this price."

Even though the Superloop share price has climbed past the $1 mark since Monday, this could be a situation where the story is far from finished.

Aussie Broadband clearly wants larger scale to compete with the larger telcos, and even Superloop shareholders agree the marriage makes sense.

But just not at this price.

CMC Invest currently shows all five analysts covering Superloop rating the stock as a buy.