There is no doubt Nvidia Corp (NASDAQ: NVDA) is one of the hottest stocks on the planet right now.

The computer chip maker is raking in sales from the artificial intelligence (AI) boom, beating expectations every quarter for the past year or so.

The stock has now rocketed 232% for the past year, incredibly rising 16.4% on a single day on Thursday US time.

Whether it can keep up this cracking pace is up for debate. Some sceptics are even suggesting the AI hype might already be a bubble.

So is there an ASX stock on fire like Nvidia?

Yes, there is.

And it's going about its business with far less publicity.

What does Audinate do?

Audinate Group Ltd (ASX: AD8) is best described as an audio networking technology provider.

The company was born out of a team working at the government research organisation National Information and Communications Technology of Australia (NICTA) in the 2000s.

Co-founder and chief executive Aidan Williams remembers the genesis when he was playing music twenty years ago.

"I was constantly connecting my synth to a mixer, to a sound card, MIDI cables, all sorts of different connections," he said.

"To me, it seemed like a networking problem. Why make all those different connections when you could integrate it into a single network?"

The solution to this ended up as Audinate's flagship product Dante.

Dante is a networking protocol that is now embedded into many audio products. The "language" allows equipment like instruments and mixers to talk to another, to produce lossless audio.

The Aussie company that could be an 'unregulated monopoly'

The innovation is now dominant enough in the entertainment industry that Medallion Financial Group managing director Michael Wayne said back in 2021 Audinate "has the potential to be an unregulated monopoly".

"You can liken it to Bluetooth, if you like. Except Bluetooth isn't as good a technology and it's owned by a cooperative."

While not widely discussed in the financial media, investors in the know have already made plenty of money from Audinate shares.

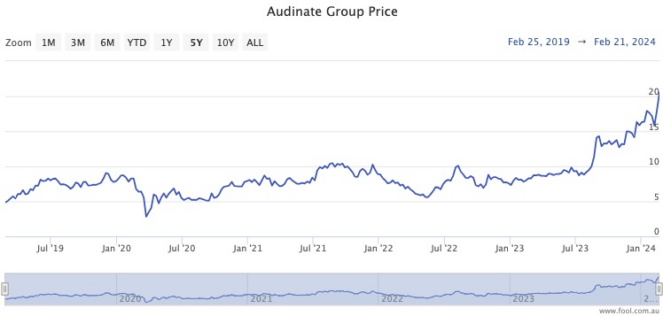

Similar to Nvidia, the stock has soared over the past 12 months, now going for 155% higher.

Over the past five years, Audinate shares have returned a phenomenal 307%, for a 32.4% compound annual growth rate (CAGR).

And many experts believe the Aussie success story still has plenty of legs.

Broking platform CMC Invest currently shows none of the seven analysts covering the stock rating it as a sell. Three say buy, while four are recommending a hold.