ASX All Ords financial stock MA Financial Group Ltd (ASX: MAF) is tanking on Thursday after the company released its full-year FY23 report.

The MA Financial share price is down 17.26% to $4.65 at the time of writing. It hit an intraday low of $4.60 in earlier trading, representing an 18.14% fall.

Let's check out the numbers.

ASX All Ords financial stock crashes as EPS declines 32%

Here are the key numbers for the 12 months to 31 December 2023:

- Underlying revenue down 11% on FY22 to $270 million

- Underlying earnings per share (EPS) down 32% to 26 cents per share

- Record annual gross fund inflows of $1.94 billion, up 27%

- Assets under management (AUM) up 18% to $9.2 billion

- Annual recurring revenue (ARR) up 23% to $178 million

- Fully franked final dividend of 14 cents per share payable on 20 March

What else happened in FY23?

MA Financial explained that its boosted ARR helped to partially offset the results of a "challenging macroeconomic environment".

There was lower corporate advisory transactional activity and revenue, weaker performance fee revenue due to lower asset valuations, and a five cents-per-share negative earnings impact from strategic growth initiatives.

MA Financial highlighted the 23% boost to ARR, record fund inflows, ongoing growth in Finsure and accelerating loan volume growth for MA Money.

The company said Finsure managed loans were up 21% on FY22 to $110 billion. The loan book grew by 150% to $983 million due to the accelerating and "extremely pleasing" growth of MA Money.

What did MA Financial management say?

Co-CEOs Julian Biggins and Chris Wyke issued a joint statement, commenting:

We are very pleased with the strong underlying momentum being experienced across the business that sees the Group very much on track to deliver on its FY26 business targets.

Despite the challenging economic backdrop, we continue to see the benefits of our diversified business model, and our intentional strategy to build a business that can deliver for investors through the economic cycle.

What's next for this ASX All Ords stock?

MA Financial released its annual report alongside its FY23 results today.

Looking ahead, MA Financial said it expected continued growth in asset management fund inflows.

However, the recurring revenue margin was expected to be lower in FY24 due to the impact of interest rates on real estate, the sale of approximately $180 million of hospitality assets, and the FY23 margin being elevated due to the strong performance of private credit funds.

The company is targeting a break-even run rate for MA Money in 2H FY24 and ongoing growth in Finsure's revenue.

MA Financial will continue investing in strategic initiatives, including the US Private Credit platform, MA Brand, and MA Money. This is expected to impact FY24 earnings by six cents per share.

MA Financial share price snapshot

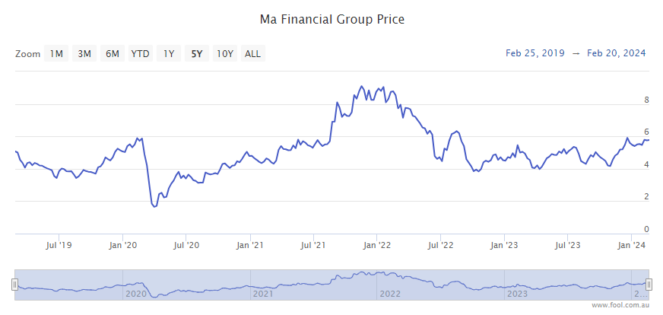

This ASX All Ords financial stock has fallen 7.4% over the past 12 months.

Over the same period, the S&P/ASX All Ordinaries Index (ASX: XAO) has risen by 4.6%.

Meantime, another ASX All Ords financial stock is flying today

Insignia Financial Ltd (ASX: IFL) shares have soared on news of the company's 1H FY24 results.

The Insignia share price is currently $2.57, up 13.5%. It hit an intraday high of $2.63 in earlier trading.

The company reported a 1.2% increase in net profit after tax (NPAT) to $95.5 million and a statutory NPAT loss of ($49.9 million) compared to $45.1 million in 1H FY23.

Funds under management increased by 5.4% to $300.6 billion.

The ASX All Ords financial stock will pay an unfranked interim dividend of 9.3 cents per share on 3 April.