The Lovisa Holdings Ltd (ASX: LOV) share price has rocketed in early trade on Thursday after the company reported its half-year results.

The stock for the jewellery retailer is up 9.5% in the first few minutes after market open.

What did the company report?

- Revenue up 18.2% to $373 million

- Comparable store sales down 4.4% from 1H23

- Earnings before interest and tax (EBIT) up 16.3% to $81.6 million

- Net profit after tax (NPAT) up 12% to $53.5 million

- Interim dividend 50 cents per share, 30% franked (38 cents in 1H23)

What else happened in the first half?

The big activity for Lovisa was the continued expansion of its store network. The company reported Thursday that 74 outlets had opened during the half-year, to take the total to 854 by the end of December.

A significant milestone was achieved when the first stores in China and Vietnam were opened during the half, in Guangzhou and Ho Chi Minh City respectively.

Despite this growth, the reduction in comparable store sales late last year triggered critics to question the size of chief executive Victor Herrero's $30 million salary package. Short positions now reportedly make up around 4% of Lovisa shares.

What did Lovisa's management say?

The company has continued to deliver solid sales and profit growth and invested in the structures to support our steady global expansion. This positions us strongly to move forward with growth in both existing and new markets.

Lovisa chief Victor Herrero

What's next for Lovisa?

The company emphasised that the first seven weeks of the second half showed comparable store sales had stabilised, up 0.3% year-on-year. Total sales are 19.6% up, and Lovisa has already opened nine new stores since the start of 2024, including its first in Ireland.

"We continue to focus on opportunities for expanding both our physical and digital store network, with structures in place to drive this growth in existing and new markets and expect store rollout to continue," stated the board's report.

"Our balance sheet remains strong with available cash and debt facilities supporting continued investment in growth."

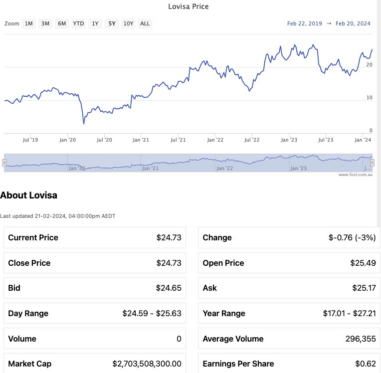

Lovisa share price snapshot

Before trade on Thursday, Lovisa shares had soared 37% since late November. The retail stock has returned an impressive 155% over the past five years.