ASX lithium shares are a problem child for many investors at the moment.

Lithium prices have plunged horribly and that's meant that pretty much any stock related to the battery ingredient has copped moderate to severe losses.

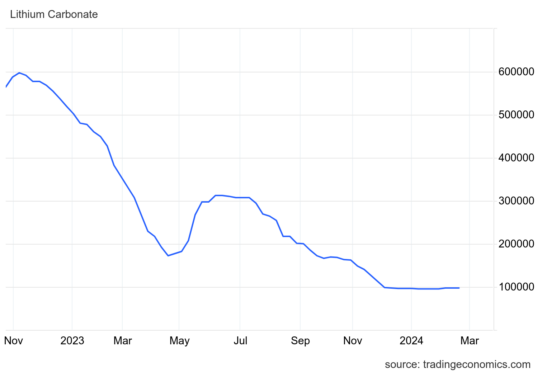

Back in November 2022, which was only 15 months ago, each tonne of lithium carbonate was going for near enough to 600,000 CNY. Now it can't even sell for six digits.

And 2024 is off to a poor start.

"New estimates showed that new electric vehicle sales in China plunged by nearly 40% from the previous month in January, stretching the pessimism following the slowdown from the previous year," stated TradingEconomics.

"The slowdown in electric vehicle sales in China limited lithium demand for battery manufacturers, driving factories to skip their typical restocking season."

For some miners, extracting lithium has become uneconomic, so they have responsibly shut down their projects.

But, of course, this exacerbates the downward pressure on their stock price as investors don't want to have their money parked in a non-productive asset.

This lithium mine is still producing at a profit

Incredibly, amid this bleak situation, experts are still insisting that those willing to invest long-term should pounce on the current low prices.

The fact remains the world will need a lot of lithium to produce all the batteries required for transition to net zero. The electrification of fossil fuel technologies is an irresistible long-term movement.

Recent conflicts in places like Ukraine and the Middle East have only served to remind nations that reducing their dependence on traditional energy sources could be smart politically, as well as environmentally.

The team at Blackwattle Investment Partners is in no doubt as to which lithium stock it is backing from here onwards.

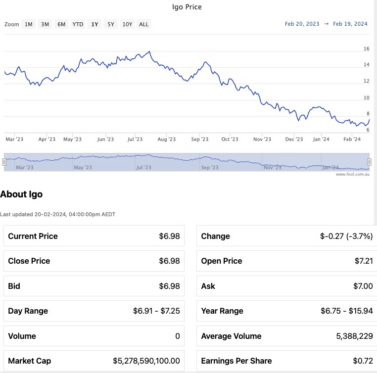

Shares for IGO Ltd (ASX: IGO) have now lost a painful 56.7% since July.

"IGO has been a poor performer due to falling lithium prices," Blackwattle analysts said in a memo to clients.

"We believe IGO provides investors with exposure to the best lithium mine in the world, Greenbushes, which is producing at a cost still well below current weak spodumene prices."

The team has done its research to deduce that the current malaise will ease sooner or later.

"Recently we spent some time meeting with downstream lithium converters and cathode manufacturers, and the conclusion was that destocking is gradually easing, and inventories are back down to three months' supply.

"High-cost Chinese lepidolite supply has also started to reduce given current spot prices."

According to CMC Invest, nine out of 17 analysts currently rate IGO Ltd as a buy.