The global gold market is going strong but there is one miner of the precious metal that's struggling.

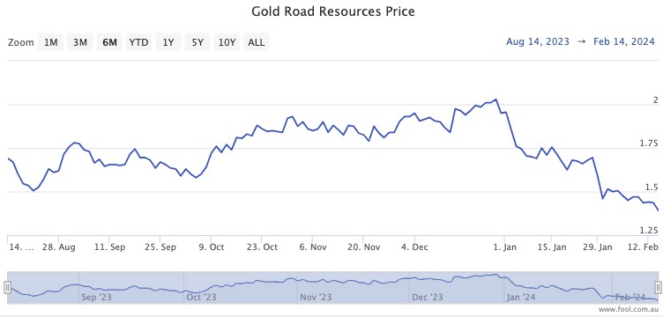

The share price for Gold Road Resources Ltd (ASX: GOR) has nosedived 31% since 28 December.

But fear not, the team at Blackwattle reckons that presents a buying opportunity for the ASX gold stock.

Superb asset quality

The latest business update was what prompted investors to flee Gold Road like it was a burning building.

"Gold Road Resources fell 22.6% in January following a poor December quarterly update, and a downgrade to CY24 guidance," read the Blackwattle memo to clients.

Its production had a shocker in recent months.

"Volumes unexpectedly fell in the final quarter of the year due to labour availability issues in drill and blast, resulting in higher costs and lower cash/earnings."

However, gold prices remain buoyant.

According to TradingEconomics, gold hit US$2,000 an ounce on Thursday. Only 16 months ago it was languishing at US$1,525.

Perhaps that's why the Blackwattle experts are backing Gold Road Resources in the long run from here.

"While disappointing, the labour issues should be temporary, while the asset quality of Gruyere — long life, open pit, 300koz per annum in a tier-1 jurisdiction — remains lasting."

The only gold stock not requiring huge capex

Plenty of Blackwattle's peers agree on Gold Road's outlook.

According to CMC Invest, a whopping 10 out of 15 analysts believe the gold stock is a strong buy at the current price.

"With Gold Road Resources the only name in our coverage without significant upcoming growth capex spend/lower capex risk, we reiterate our buy rating," reported Goldman Sachs Group Inc (NYSE: GS) analysts.

The Blackwattle team warned that the market is skittish at the moment, so long-term investors must hold their nerve.

"The strong market performance over recent months and heightened valuations have increased the susceptibility to a pullback for companies that disappoint.

"The guidance provided by companies will be crucial, especially given the weaker economic conditions."