The Treasury Wine Estates Ltd (ASX: TWE) share price is up 3.9% in early trade on Thursday despite the company putting out lukewarm half-year earnings results in the morning.

What did the company report?

- First half 2024 net profit after tax down 11% to $166.7 million

- First half 2024 revenue up 0.4% to $1.3 billion

- First half 2024 earnings down due to some product sales weighted to the second half

- Interim dividend 17 cents, compared to 18 cents last year

The results come as Beijing is undertaking a review of punitive tariffs on Australian wine imports into China. Warmer diplomatic relations between the two nations may mean the tariffs are reduced, which will reopen a massive export market for Treasury Wine after it was lost in 2020.

What else happened in the first half?

The big news in the first half was Treasury Wine's acquisition of Daou vineyards business in the US for about $1.4 billion.

Luxury wines carried the business with net sales revenue up 4.3%, while premium and commercial portfolio respectively lost 2% and 6.5%.

What did management say?

Commenting on the results, Treasury Wine chief executive Tim Ford said:

I am pleased with the ongoing underlying performance of Treasury Wine Estates this period, with strong consumer demand for our priority Luxury brand portfolio continuing around the globe.

Penfolds continues to perform and strengthen, whilst Treasury Americas has made significant progress in reshaping its portfolio focus with continued growth of its Luxury brands now supported by the acquisition of DAOU in December. The Premium wine category, whilst resilient, is highly competitive and we continue to innovate and invest to achieve the goal of outperforming the category and importantly attracting new consumers to wine.

What's next?

Aside from the massive potential catalyst of China's tariff review, Ford said that the company was "on track to deliver mid-high single-digit earnings growth in F24".

"We remain confident that our premiumisation strategy, preeminent brand portfolio and attractive market fundamentals at Luxury price points will allow us to continue to deliver our long-term growth ambitions."

Treasury Wine share price snapshot

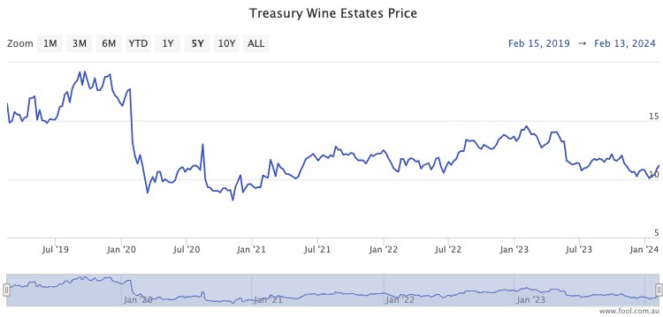

Treasury shares had been down 16.1% over the past 12 months before trading on Thursday. The stock is now trading almost 42% lower than its pre-COVID high.