The Origin Energy Ltd (ASX: ORG) share price is gaining on Thursday morning amid its FY2024 first-half results.

Shares in Australia's largest listed utilities company by market capitalisation are up 3% to $8.83 at the time of writing. Meanwhile, the S&P/ASX 200 Index (ASX: XJO) is rallying 0.9%, overtaking the 7,600-point level.

Origin share price forge higher on strong growth

Origin released the Kraken in the half ending 31 December 2023, so to speak, crushing it in many aspects of its business.

- Total group revenue down 9% from prior corresponding period to $7,996 million

- Statutory profit up 149% to $995 million

- Underlying profit increasing from $44 million to $747 million

- Underlying EBITDA up 88% to $1,995 million

- Fully franked interim dividend of 27.5 cents per share, up from 16.5 cents

Flicking through Origin's results, it quickly becomes evident what boosted underlying profit during the half. The energy market division saw $813 million EBITDA flow through due to a recovery in wholesale prices, lower electricity generation, and reduced procurement costs.

Integrated gas, which encompasses Origin's share of Australia Pacific LNG (APLNG), acted as a drag. A fall in realised oil prices created a $179 million headwind for the company's underlying profit. However, this was more than made back by earnings sourced by hedging and other LNG trading, generating $296 million.

What else happened during the first half?

In a big move, Origin outlaid around $530 million Australian dollars to up its stake in UK technology and energy company Octopus Energy on 18 December 2023. The Origin share price moved higher after revealing the move to go from a 3% holding to 23% as part of a funding round for Octopus.

Origin CEO Frank Calabria highlighted the success of Octopus Energy in today's release, stating:

Octopus Energy continues its impressive growth trajectory, becoming the second largest energy retailer in the UK and growing Kraken technology licensing to more than 50 million accounts contracted worldwide, reinforcing our belief in its unique capabilities and strong platform for future growth.

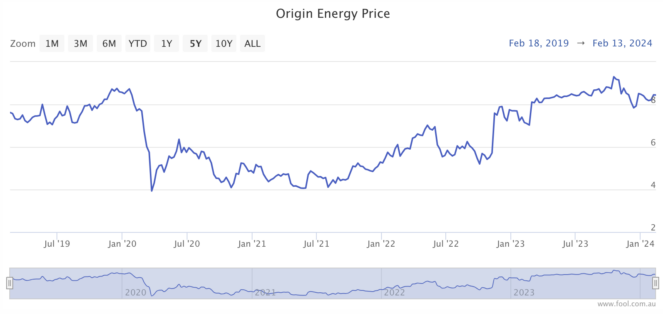

On a different note, the takeover talks between Origin and the combined Brookfield and EIG outfit were officially laid to rest on 7 December 2023. Interestingly, the Origin share price has gradually increased since then, as shown below.

What did Origin management say?

Origin expects "increased value opportunities" for its battery projects amid greater intra-day electricity price volatility and unplanned outages. Just this week, half a million Victorians were left without power as AGL suffered a complete shutdown.

Outlining the company's plans for further developments, Calabria noted:

We have continued to accelerate renewables and storage in our portfolio, having committed approximately $1 billion to develop two large scale batteries at our Eraring and Mortlake power stations. We also acquired a prospective 500 MW greenfield wind development in New South Wales and are progressing potential offshore wind projects in Victoria and New South Wales.

What's next?

Guidance for both FY2024 and FY2025 were provided today — though details on the latter were sparse.

FY2024:

- Energy Markets EBITDA is expected to be between $1,600 million to $1,800 million (excluding Octopus Energy).

- Octopus Energy EBITDA is expected to be positive, but less than $100 million.

- APLNG production is slated to be between 680 petajoules (PJ) to 710 PJ

FY2025:

Origin believes energy markets EBITDA will be hampered by a decline in regulated customer tariffs. The softening is forecast to be somewhat offset by a lower cost base.

Origin Energy share price at a glance

The Origin share price has performed solidly over the past year, leaping 23.7%. For context, the Aussie benchmark is only 3.5% better off than a year ago. Most of this gain occurred around February last year when takeover bids were being lobbed its way.