After more than a year of excitement surrounding Origin Energy Ltd (ASX: ORG), shareholders rejected a proposed takeover at the rescheduled meeting earlier this week.

Origin told the market in an ASX announcement today that the takeover process had officially ended.

Termination of scheme implementation deed

This followed a meeting held earlier this week on the proposed acquisition of Origin involving Brookfield and EIG through a scheme of arrangement.

On 4 December 2023, the offer was not approved by the required majority of shareholders at the meeting, which was needed for the takeover to proceed.

Therefore, Origin advised that it has today terminated the scheme implementation deed.

What now for Origin shares?

It seems unlikely that Brookfield will return with another approach considering AustralianSuper has such a large presence on the share register.

When the vote was rejected, the Origin chair Scott Perkins said:

We look forward to the continuing support of our shareholders as we focus on delivering on our strategic priorities, accelerating investment in cleaner energy and storage and pursuing our ambition to lead the energy transition.

Origin now has to get on with the job of investing billions of dollars into decarbonising its energy generation.

Interestingly, AustralianSuper said it was a "long-term investor in the Australian economy and is open to providing capital to assist Origin as it prepares to transition over the coming decades".

AustralianSuper will also reportedly back the current Origin board, while some shareholders said there should be a demerger and bigger dividends.

The company has said its long-term ambition is to achieve net zero scope 1, 2 and 3 emissions by 2050, with a 40% reduction by 2030.

It also wants to grow its renewables and storage capacity to 4GW by 2030 while reducing emissions from existing operations, including the planned accelerated Eraring closure.

Origin also expects hydrogen to play "an important role in the future global energy mix, particularly in hard-to-abate sectors such as heavy industry and some forms of transport". It's exploring both domestic and export market opportunities for hydrogen and ammonia.

It will take a lot of capital to see these plans through.

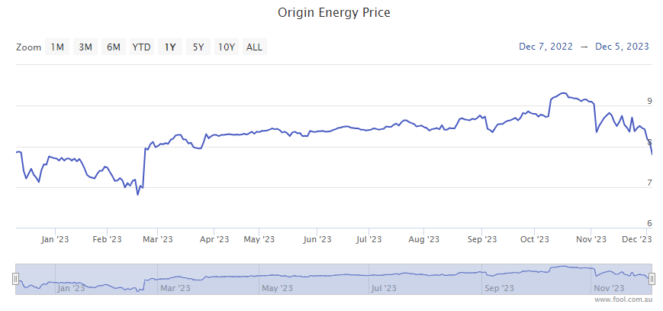

Origin share price snapshot

The Origin share price is up more than 1% over the past year, despite the takeover collapsing.