Commonwealth Bank of Australia (ASX: CBA) just reported a fairly underwhelming FY24 half-year result. But, pleasingly, the CBA dividend got a slight boost. Let's find out what you need to know.

In terms of the actual result, it reported a 3% fall of the cash net profit after tax (NPAT) to $5 billion and an 8% decline in the statutory NPAT to $4.8 billion. But, it made enough profit to justify a larger payout than last year.

CBA dividend

The ASX bank share declared a fully franked half-year dividend of $2.15 per share, which was 2% higher than the FY23 first-half dividend.

This payout represented a dividend payout ratio of 72% of cash NPAT, meaning the bank is keeping 28% of its profit to re-invest into the business and/or improve the balance sheet.

The dividend reinvestment plan (DRP) is still active and is available for shareholders, though no discount will be applied to the shares allocated under the plan for the interim dividend. CBA expects to buy all of the shares on the market to satisfy the shares needed for the DRP.

The ex-dividend date for this upcoming dividend is 21 February 2024, so investors will need to own shares by the end of trading on 20 February 2024 to gain entitlement to this dividend. The DRP participation date is 23 February 2024.

The CBA dividend is expected to be paid on 28 March 2024, which is a month and a half away.

The bank has also been returning cash to shareholders via its share buyback. It said it had completed $154 million of the $1 billion share buyback.

How big is the dividend yield?

At the current CBA share price, the $2.15 per share payout represents a fully franked dividend yield of 1.9% and a grossed-up dividend yield of 2.7%.

The latest two dividends – this one and the one six months ago – amount to a fully franked dividend yield of 4% and a grossed-up dividend yield of 5.75%.

CBA share price snapshot

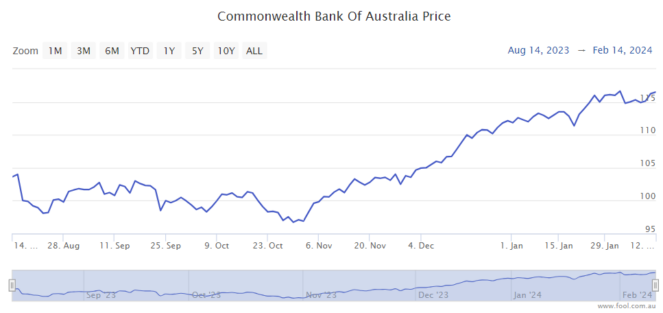

Over the past six months, CBA shares have gone up 9%.