One of the biggest challenges for long-term investors is to keep the faith when a business is going through tough times.

There are plenty of moments when faith will be tested, but as long as the original investment thesis still holds and any problems are deemed to be temporary, long-termers need to fight through their anxiety.

Here's a pair of such cheap shares representing quality companies that could be a bargain right now:

Japan 'disappointing', but home market still going strong

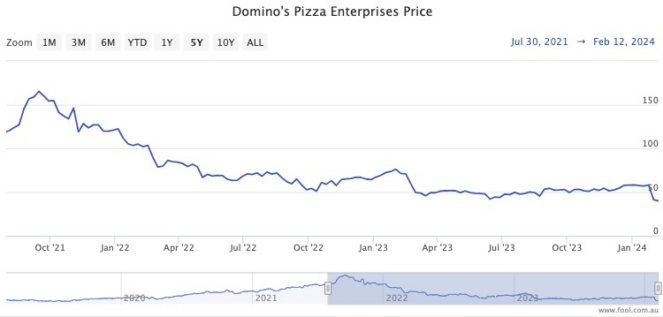

As the dominant pizza retailer in the country, Domino's Pizza Enterprises Ltd (ASX: DMP) used to be a market darling.

But a series of missteps in recent times has seen the stock price plummet more than 74% since September 2021.

Unfortunately, 2024 is off to a shocker as well.

After a January briefing to the market, Domino's share price plunged 31% in a single day.

Bell Potter advisor Christpher Watt agreed the earnings update was "disappointing".

"The business in Japan is underperforming and weighing on group performance," Watt told The Bull.

"However, results in Australia and New Zealand were positive."

That's why the Bell Potter team thinks it could be an ideal entry point for the fast food stock.

"We believe the stock has been oversold as Domino's remains a leader in the sector."

These cheap shares won't stay down for long

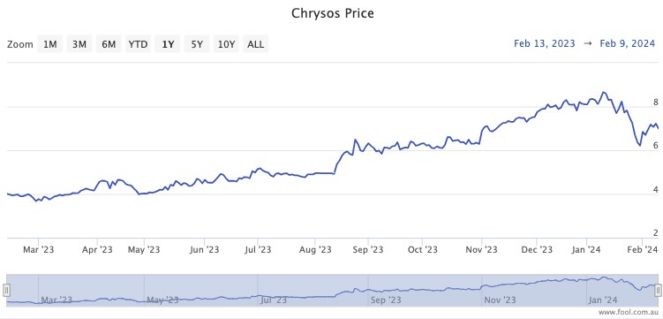

While Chrysos Corporation Ltd (ASX: C79) was one of the darlings of 2023, the new year has been less kind.

The share price has dived 18% since 10 January.

"Chysos was recently sold down after missing revenue expectations in the second quarter of fiscal year 2024," said Shaw and Partners senior investment advisor Jed Richards.

Chrysos' main product is named PhotonAssay, which tests samples for minerals like gold, copper, and silver on behalf of mining clients.

Richards is not worried about the downturn this year.

"Delays in the number of PhotonAssay unit installations reflect timing issues as opposed to a reduction in demand.

"We view the share price reaction as overdone, presenting attractive entry levels for investors."