Regular readers would know that there are many ways to reach the magic million using the power of ASX shares and compounding.

However, what you're really wanting to know is which stocks will take you there.

One stock that many experts are bullish on is low-cost jewellery retailer Lovisa Holdings Ltd (ASX: LOV).

Let's examine whether Lovisa shares have the chops to take you to seven figures:

What does Lovisa do?

Lovisa operates a network of "fast fashion" jewellery shops both in Australia and overseas.

Although the business started in Sydney, its stores can now be seen in places as far-flung as Hong Kong, Namibia, France, the US, the UAE, and Colombia.

The retail chain has a presence in 40 countries via 830+ stores, according to the last quarterly update.

How is the business going?

Although it's definitely a consumer discretionary stock, Lovisa has withstood the recent economic downturn better than some others because of its low-cost niche.

Its target demographic also skews to younger generations, who are less likely to be under pressure from higher mortgage repayments.

The company is also on an expansion tear, with its first store openings in China and Vietnam imminent. They are both countries that have a fast-growing middle class market.

Total sales in the September quarter grew 17% year-over-year, while the 2023 financial year numbers saw revenue rise 30%, earnings before interest and tax (EBIT) increase 27.9%, and net profit after tax (NPAT) head up 16.7%.

Are Lovisa shares a millionaire maker?

Lovisa is an unusual investment in that it can be considered both a growth stock and a dividend producer.

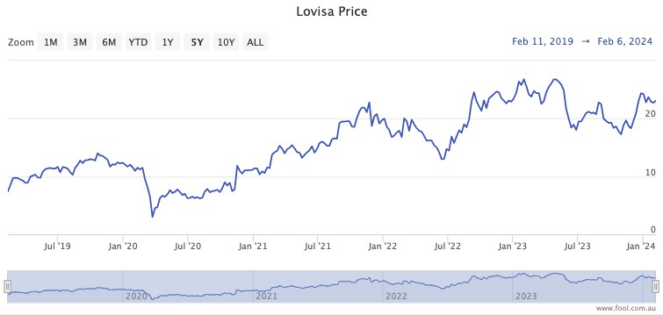

The share price has gained an amazing 239% over the past five years. Meanwhile the stock has paid out a 2.9% dividend yield, which is 70% franked.

Of course, if you had the foresight to buy Lovisa shares a half-decade ago, that yield would now incredibly exceed 9.5%.

And the professional community is largely optimistic about the business' outlook.

Nine out of 14 analysts currently surveyed on CMC Invest reckon the stock is a buy.

So, yes, Lovisa shares have a decent chance of making you a millionaire.

Buyer beware though

But there are two caveats.

The first is that if you buy this stock, it should be part of a well-diversified portfolio.

There are no certainties in life. So you'll want to make sure if Lovisa doesn't perform as expected, other stocks could step up.

The second is that the past is no guarantee of future performance.

The last five years have been pretty impressive for Lovisa shares, but that says nothing about how they will go in the next five.