When is the best time to buy ASX shares? It's when everyone else hates them!

It sounds obvious, but buying a stock when it's cheap provides the best returns later.

You'd be surprised how many people insist on grabbing shares when everyone else loves them and they're already expensive.

In the bargain-hunting spirit, the team at QVG Opportunities Fund recently named two ASX shares that had a pretty ordinary January that they're still backing for long-term gains:

Is this stock severely under-priced?

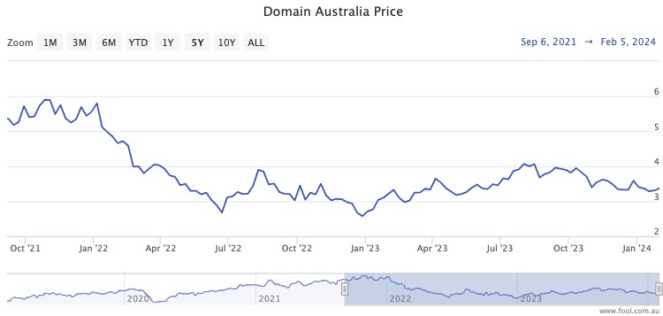

It's been a sorry tale for real estate classified provider Domain Holdings Australia Ltd (ASX: DHG).

In the midst of 13 interest rate rises dampening the property market, the Domain share price has plunged almost 39% since the start of 2022.

The slide continued last month as the company kept struggling against the market leader REA Group Ltd (ASX: REA).

"Domain continued to soften after a poorly-received AGM update which showed listing volumes were tracking behind their major competitor," stated the QVG analysts in a memo to clients.

"This listings volume discrepancy is largely explained by geographic mix, but given Domain's patchy historic financial performance the market is disinclined to give them the benefit of the doubt."

But as far as the QVG team is concerned, the Domain share price has slid too much considering the bullish business prospects from this point on.

"Domain has opened a very wide valuation gap between itself and REA Group. This gap is even wider than it first appears if you believe Domain can expand its margins over the next few years."

The ASX shares with catalysts imminent

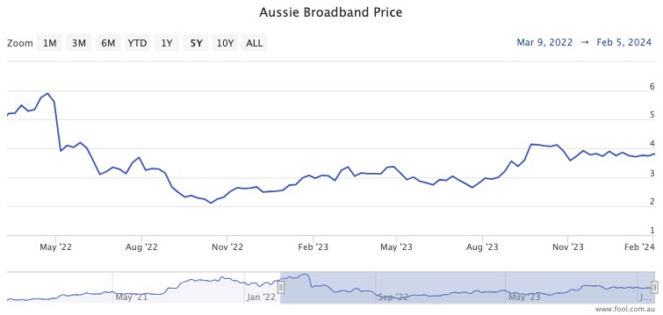

The Aussie Broadband Ltd (ASX: ABB) has lost a painful 35% since April 2022.

However, the market has been positive over the past four months since revealing its proposed acquisition of business telco Symbio Holdings Ltd (ASX: SYM).

It did have to go to market with a cap in hand though.

"Aussie Broadband continues to digest the large placement it made in November."

The QVG Opportunities Fund retains Aussie Broadband shares as its fifth largest holding because the business simply has too many tailwinds coming to ignore.

"Aussie has a number of upcoming catalysts the most imminent of which is the completion of its acquisition of Symbio and articulation of the synergies associated with this purchase."