Three S&P/ASX 200 Index (ASX: XJO) shares just received substantial upgrades from leading brokers.

Two of the stocks have outpaced the benchmark index in 2024, while one is deep in the red.

But according to top Aussie brokers, the outlook for all three ASX 200 shares looks bright.

Here's what you need to know.

(Broker upgrade figures courtesy of The Australian.)

Three ASX 200 shares tipped to outperform

First up we have vertically integrated poultry producer Inghams Group Ltd (ASX: ING).

As you can see on the chart above, the ASX 200 share has been on a tear over the past five months, with the stock up 57% since 15 August. In morning trade today, shares are swapping hands for $4.46 apiece.

The most recent share price surge followed a promising half-year update on 31 October.

Investor enthusiasm was roused when the ASX 200 share forecast a 110% increase in underlying net profit after tax (NPAT) to $71 million for the first half of FY 2024. Management said statutory NPAT could leap 278% to $65 million.

Despite the huge share price gains already in the bag, Bell Potter sees more growth ahead.

The broker raised Inghams to a buy rating with a $4.90 target price. That represents a 10% potential upside from current levels.

Inghams trades on a fully franked 3.4% trailing dividend yield.

Moving on…

The second ASX 200 share getting a broker upgrade today is lithium stock and diversified resources producer Mineral Resources Ltd (ASX: MIN).

The Mineral Resources share price has come under significant pressure amid a crash in global lithium prices. That sees that stock down 37% over the past 12 months, currently trading for $55.08 a share.

On the positive side, in late January Mineral Resource reported that its Wodgina, Mt Marion and Bald Hill lithium projects all remain profitable at the current depressed lithium prices.

Management also expects costs at Wodgina and Mt Marion to come down in 2024.

JPMorgan believes the ASX 200 share has suffered through the worst of it. The broker raised Mineral Resources to an overweight rating with a $77 price target. That represents a 40% potential upside from current levels.

Mineral Resources trades on a 3.4% fully franked trailing dividend yield.

Which brings us to the third ASX 200 share getting a broker upgrade today, wholesale distributor Metcash Ltd (ASX: MTS).

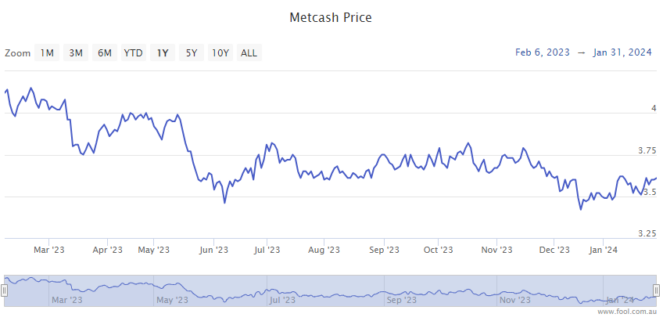

The Metcash share price is down 13% over 12 months but has gained 3% so far in 2024. Shares are currently trading for $3.60 apiece.

A lot's been happening with Metcash just over the past week, particularly relating to the company's growth outlook.

Yesterday Metcash announced it was undertaking a $325 million capital raising.

As Motley Fool analyst James Mickleboro noted, the raising is to fund the acquisition of "three strategically aligned businesses that deliver further diversification and resilience, and an even stronger growth trajectory".

Superior Food is the primary acquisition, for an enterprise value of up to $412 million.

This morning the ASX 200 share reported it had completed the oversubscribed capital raising.

Jeffries sees a good run ahead for this ASX 200 share. The broker raised Metcash to a buy rating with a $4 price target. That represents an 11% potential upside from current levels.

Metcash trades on a 6.1% fully franked trailing dividend yield.