ASX tech stock Bailador Technology Investments Ltd (ASX: BTI) looks to be a great investment option right now. In fact, I'd rather invest in it than the electric vehicle maker Tesla Inc (NASDAQ: TSLA).

Let me start by saying I'm not suggesting it's going to perform as well as Tesla has done over the long term — I mean from today onwards.

Tesla has performed incredibly well in the last few years, and it might continue to do very well. However, the US giant does now have a huge market capitalisation, and there is growing competition from other car makers manufacturing electric cars, including China's BYD.

There are a few key reasons why I like Bailador, which primarily invests in relatively small, unlisted tech companies. It describes itself as a growth capital fund focused on the information technology sector.

Let's get into why I think it's got great return potential.

Strong revenue characteristics

Bailador says it typically invests between $5 million to $20 million in companies seeking growth-stage investment.

There are particular areas it likes to look at for opportunities: software as a service (SaaS) and other subscription-based internet businesses, online marketplaces, software, e-commerce, high-value data, online education, telecommunication applications and services.

Bailador invests in businesses with the ability to generate repeat revenue, they should have a huge market opportunity, and they typically generate revenue from international sources.

Software platform Siteminder Ltd (ASX: SDR) is currently its biggest position. It was listed on the ASX after Bailador's initial investment and has grown enormously. Siteminder is a world leader in hotel channel management and distribution solutions for online accommodation bookings. In the FY24 first half, Siteminder reported revenue growth of 27.9%.

Before Bailador sold its stake in Instantscripts for $52 million (at an internal rate of return of 64% for the fund), that digital healthcare business had grown its revenue at more than 100% year over year.

For FY23, the Bailador portfolio revenue growth was 67%, with around 84% of revenue being recurring.

I'd expect that any future investments Bailador makes will have an attractive revenue outlook, which helps the compounding potential of revenue.

Attractive unit economics

Revenue growth isn't the only important thing – it needs to be profitable growth in the long term.

If a technology business has good margins, then additional volume should help profitability because of the operating leverage.

Bailador deliberately looks to invest in businesses that have a "proven business model with attractive unit economics".

In FY23, the gross profit margin of the ASX tech stock portfolio's company holdings was around 62%. Future investments may have an even higher gross profit margin.

Investors usually focus on the profit potential of a business, and the underlying businesses could be very profitable in the future. It can take a while to get to profit-making status – just look at how long it took Tesla. Siteminder expects to be underlying earnings before interest, tax, depreciation and amortisation (EBITDA) and underlying free cash flow positive in the second half of FY24.

Big valuation discount of the ASX tech stock

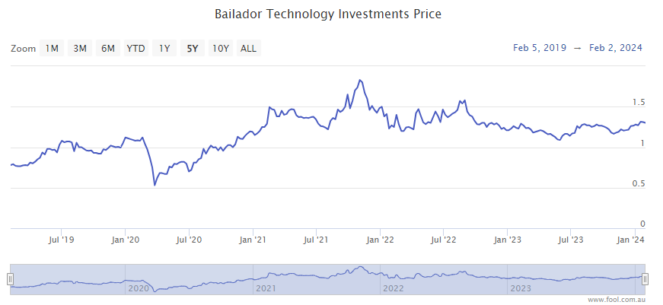

I think the Bailador share price is trading at a very attractive discount.

The company said it had pre-tax net tangible assets (NTA) of $1.77 and post-tax NTA of $1.64 at 31 December. The current Bailador share price is around $1.31, which is a 20% discount to the post-tax NTA. The improving wider economic picture could lead to investors seeing value in this ASX tech stock.

Those NTA figures may actually be conservative and underestimate the value of its current investments.

Bailador sold InstantScripts to Wesfarmers Ltd (ASX: WES) at a price 25% higher than what it had valued InstantScripts at – the carrying value.

Bailador also recently saw Rezdy taken over by a US private equity fund, which increased its equity valuation of Rezdy by approximately 46%.

Siteminder's valuation is decided by its daily share price, but other Bailador investments like Access Telehealth and Rosterfy could be worth more than the ASX tech stock is currently valuing them at.

I think there's good potential for the ASX tech stock's NTA discount gap to close, and the strength of the underlying growth may drive these businesses higher.