Even though there are numbers and graphs everywhere, more often than not the stock market does get too emotional.

Sure, some businesses endure tough times, but the mob fear of avoiding such investments can drive the share price down excessively.

And this is when shrewd investors can take advantage, scooping them up for cheap and just patiently waiting for the market to compose itself again.

Here are two such S&P/ASX 200 Index (ASX: XJO) examples that expert are tipping as buys at the moment:

Undervalued with 'attractive dividend yield'

Despite buoyant times for the energy market over the past two years, AGL Energy Limited (ASX: AGL) has not been able to make hay.

The share price has sunk 27% since July, and is a shocking 58% off its pre-COVID peak.

Ord Minnett senior investment advisor Tony Paterno reckons it's a great time to buy.

"In our view, the longer-term outlook remains solid," Paterno told The Bull.

"AGL was recently trading on a low forecast fiscal year 2024 price/earnings multiple below 10 times and offers an attractive dividend yield, mostly franked from fiscal year 2025 onwards."

Indeed the stock currently offers a yield of 3.4%.

Paterno admits there will be significant capital expenditure looming, but the stock is just too cheap to ignore.

"We're forecasting relatively flat earnings over the long term, as investments in renewable energy and batteries offset the expiry of cheap long-term coal contracts and the closure of coal power stations."

Six out of eight analysts that cover AGL shares currently rate them as a buy, according to CMC Invest.

This ASX 200 company could be ripe for a takeover

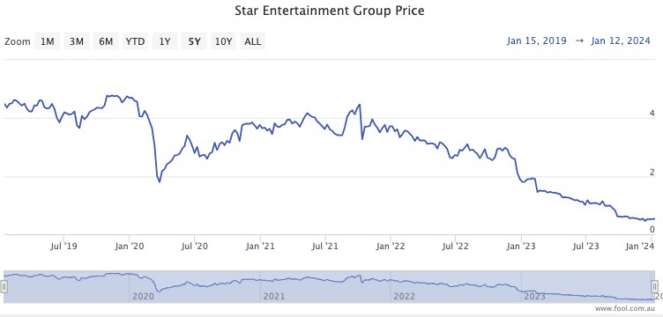

Since casino rival Crown went private, Star Entertainment Group Ltd (ASX: SGR) could make a case as the most maligned ASX 200 stock of the last two years.

Much-publicised government scrutiny into its risk management issues have painfully forced the share price 86% down since the start of October 2021.

"The company reported a statutory loss of $2.435 billion, which includes non-cash impairments, in fiscal year 2023," said Red Leaf Securities chief executive John Athanasiou.

He reckons, though, enough is enough.

"We believe the shares have been oversold.

"The market hasn't priced in the possibility of a recovery, or the company appealing as a potential takeover target."

CMC Invest shows five out of six analysts agree with Athanasiou that Star Entertainent is a buy right now.