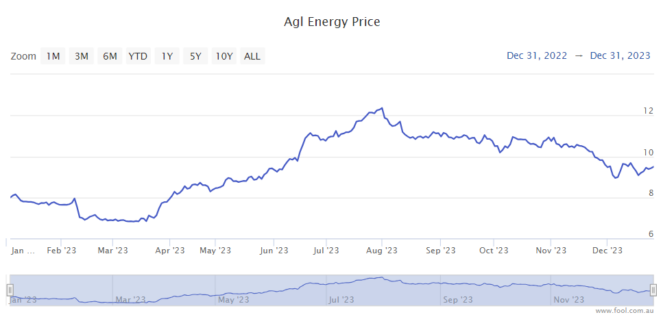

The AGL Energy Ltd (ASX: AGL) share price did really well in 2023, rising by 18%. It essentially doubled the return of the S&P/ASX 200 Index (ASX: XJO), which increased by around 9%.

The company had a very interesting year – between March to the start of August, it rose by around 75%. Then, between the start of August and the end of the year, it slid by 23%.

What sent the AGL share price higher?

When AGL announced its FY23 first-half result, it said the outlook beyond FY23 remained positive, with wholesale electricity pricing remaining "elevated" compared to prior periods, with AGL "expected to benefit as historical contract positions are reset in FY24 and FY25", which were expected to flow through to retail pricing outcomes.

In June, the company upgraded its FY23 underlying net profit after tax (NPAT) guidance to between $255 million to $285 million (up from the previous guidance of $200 million to $280 million). It also gave guidance for FY24, which said underlying NPAT could at least double to between $580 million to $780 million.

AGL reiterated that sustained periods of higher wholesale electricity pricing were helping, as well as expected improved plant availability and flexibility of its energy generation, including the start of operations at the Torrens Island and Broken Hill batteries, as well as forced outages not happening again.

Where did it go wrong?

Higher wholesale prices helped send the AGL share price higher and FY24 could be a good year for profit.

However, the wholesale prices have been dropping back, which could mean that profit may not grow as much as investors previously expected in subsequent years.

In December, I reported:

As the ABC recently reported, a warm winter and increasing numbers of rooftop solar have seen wholesale electricity prices decline.

AGL is currently benefiting from the prior, higher wholesale prices but as that rolls off it could mean reduced profitability compared to FY24, which may be why AGL shares are drifting lower.

The ABC reported in October that in the prior three months, wholesale power prices in the national grid were less than half of what they were 12 months before. Prices remain significantly lower than they were before.

It can reportedly take roughly a year for wholesale energy prices to lead to lower retail prices.

What is the AGL share price valuation?

Investor thoughts on the profit can have an impact on the valuation. According to Commsec, the ASX energy share is valued at just 9 times FY24's estimated earnings.