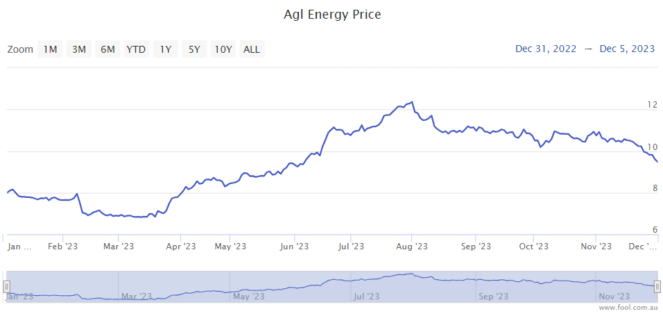

The AGL Energy Limited (ASX: AGL) share price suffered a 12% decline in November, significantly underperforming the S&P/ASX 200 Index (ASX: XJO) which rose by 4.5%. This means that the ASX energy share underperformed by more than 16%.

Disappointingly, the AGL share price has continued to fall in December. In the month to date, it has dropped 4% and since the end of October 2023, the company has seen a decline of 16%.

As a reminder, the company has two main segments – retailing to customers, and energy generation.

What's going wrong for AGL shares?

The company is currently experiencing a boost to its underlying net profit after tax (NPAT) thanks to wholesale prices that have significantly increased. AGL has forecast that FY24 underlying NPAT could at least double thanks to those higher wholesale prices (being locked-in) and improved availability of its energy generation.

That's the good news. But the market normally focuses on the long-term, and the outlook isn't looking as good as it was before.

As the ABC recently reported, a warm winter and increasing numbers of rooftop solar have seen wholesale electricity prices decline.

AGL is currently benefiting from the prior, higher wholesale prices but as that rolls off it could mean reduced profitability compared to FY24, which may be why AGL shares are drifting lower.

The ABC reported in October that in the prior three months, wholesale power prices in the national grid were less than half of what they were 12 months before. Prices remain significantly lower than they were before.

It can reportedly take roughly a year for wholesale energy prices to lead to lower retail prices. This also means it will take a while for lower profit to be reflected in AGL's financials, but it is on the horizon if it stays this way.

There is a higher chance of a hot summer due to El Nino, which could lead to higher prices, though the increasing presence of solar and cheaper coal may offset this.

AGL itself faces a path of large-scale investment into renewable energy generation and energy storage in the years ahead. That will take a lot of capital.

Unless wholesale energy prices turn around, it becomes more likely that AGL's medium-term won't be as strong as previously forecast.

Is there a silver lining for the ASX energy share?

Broker UBS thinks there are some positives ahead for wholesale electricity prices because of the potential exit of some/all of the Origin Energy Ltd (ASX: ORG) Eraring Power Station capacity in mid-2025 and lower generation availability from competitors.

UBS points out that the last time southern weather patterns transitioned from La Nina to El Nino, wholesale electricity prices lifted 30% year over year in a 12-month period.

AGL share price snapshot

Since the start of 2023, the AGL share price has climbed by 12.50%.