Investors are refraining from bidding up prices in ASX lithium shares on Friday in a muted end to the first week of 2024 trading.

The once exuberant sector is wrestling with the fickleness inherent in commodities — an industry always at the whim of prevailing supply and demand dynamics. This is a lesson many lithium investors have discovered over the last year as prices have declined amid an oversupply.

Today, lithium appetite is tempered as a telling sign takes its toll.

Putting ASX lithium shares on edge

It's no secret the price of lithium — a material commonly used in electric vehicle (EV) batteries — is a shadow of its former self. The untimely combination of increased lithium supply and slowed EV demand has put a dent in the commodity's price, to put it lightly.

At its peak, a tonne of electrifying material could bring around US$84,000. Today, that figure is skimpy US$13,500, according to Trading Economics.

The obvious negative is lithium miners will see revenues fall for the same amount of production. All else being equal, this translates into reduced profits.

However, worse still is when the lithium costs more to mine than what it can be sold for. This is when the management team need to make a call on whether to keep operating at a loss or cease mining altogether.

Core Lithium Ltd (ASX: CXO) made that call this morning by providing an update to the market. In its release, the Northern Territory lithium company informed investors it would suspend mining activities due to weak lithium prices.

The decision indicates the price of lithium is now hovering around uneconomical levels for some.

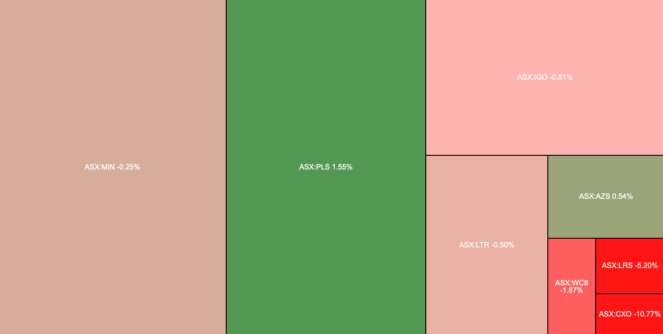

As the heat map of ASX lithium shares shows, the sector is mostly shrouded in red following the Core Lithium news. However, Pilbara Minerals Ltd (ASX: PLS) is fending off the pessimism today. The larger miner's low-cost operations could be fortifying some investors.

Being a low-cost miner allows the ability to keep producing as others are forced to withdraw. Under the worst scenario, the lowest-cost miner is the one left standing.

Who's next?

The fear among investors is which ASX lithium share could be next. In October 2023, IGO Ltd (ASX: IGO) warned shareholders it may need to reduce production at its Greenbushes mine in the second half.

Fortunately, IGO is one of the lowest-cost producers. As such, it seems IGO is attempting to maximise returns by holding its lithium for when prices might be higher.

In the meantime, ASX lithium shares will arguably be under the close eye of the market.