Many Australians aren't aware that in the S&P/ASX 200 Index (ASX: XJO) they have access to some of the best dividend shares in the world.

The reason for that is the nation's tax rules, which force a bias towards cash distributions over other methods of capital return.

When a company pays corporate tax on its profits, any dividends paid out from that will be delivered with franking credits. That allows the beneficiary to legally avoid paying tax on part or all of that income.

The principle is that the same wad of money should not be taxed twice.

Anyway, that means that Australian investors are well placed to develop a portfolio of ASX 200 dividend shares that can produce handsome passive income.

Let's take a look at one way you could rake in $450 a month for no work:

Just let it brew for four years

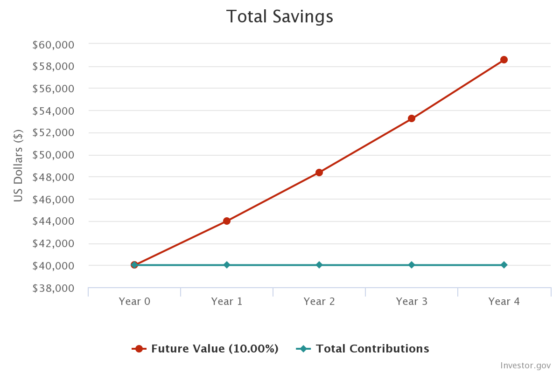

Comparison site Finder found earlier this year that the average Australian has $40,000 saved in the bank.

That would be a fine start for an ASX stock portfolio.

I put it to you that it's realistic, over the long term, to harvest 10% compound annual growth rate (CAGR) with ASX 200 dividend shares.

There are plenty of quality stocks that return a dividend yield in the high single-digits.

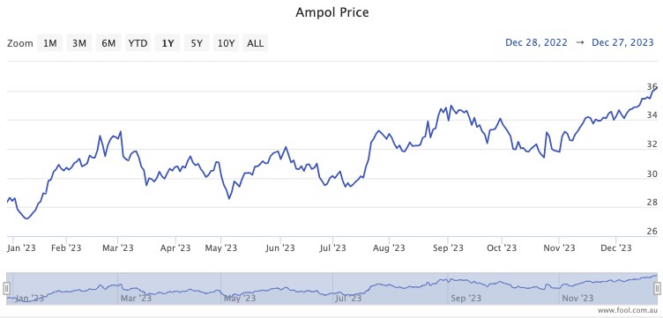

Take Ampol Ltd (ASX: ALD) as an example, which is producing a yield near enough to 7% at the moment.

Those distributions are fully franked, and the share price gained more than 30% in 2023.

So those three elements can easily add up to a total annual return of 10% or more.

Going back to the $40,000, if you can construct a diversified portfolio of ASX 200 dividend shares that can perform similarly to Ampol, then you are on your way.

If that nest egg can just manage four years that can average 10% CAGR, you have yourself $58,564.

From that point on, you can start cashing in the yearly gains for your passive income.

The 10% CAGR equates to an annual return of $5,856. This adds up to $488 of passive income each month.

Mission accomplished.