Gold has been a store of wealth for hundreds, if not thousands, of years. But, I'd rather buy beaten-up quality S&P/ASX 200 Index (ASX: XJO) shares over gold.

Gold is seen as a defensive asset class, and possibly an inflation hedge, but I'd prefer to have cash in the bank account over owning gold.

Why ignore gold?

Firstly, it's possible for gold to go down in value, even in uncertain times. Gold doesn't generate interest, rent or business profits. There's no reliable indicator of when gold prices are going to rise, or by how much.

ASX gold shares come with mining risks, and owning actual gold investments comes with costs, unless we buy and own the gold ourselves.

Buying ASX 200 shares at the right time can unlock good returns. Imagine there's a company that is at a share price of $100, and in three years it reaches $130 – that's a return of 30%. But, during those three years, imagine there's a period where it declines to $70 (or perhaps more) – a fall of at least 30% from the original price. If someone bought at $70 and held to $130, that's a return of 85% in a shorter timeframe.

Of course, we don't know when prices are going to rise or fall. We can only invest when we see good value.

Gold reportedly returned an average of 5.26% in the 10 years to 2022. If we invested $500 a month in gold and it achieved a return of 5.26% per annum, it'd take 43 years to reach $1 million.

Shares have returned an average of 10% over the ultra-long-term. It'd take 31 years of investing $500 per month to reach $1 million with shares.

APA Group (ASX: APA)

The APA share price has fallen over 25% from mid-2022 following all of the interest rate hikes.

This ASX energy infrastructure share owns a vast gas pipeline, transporting half of Australia's usage, it also owns gas storage, processing and gas energy generation facilities. The business also has a growing portfolio of electricity transmission and renewable energy assets.

I don't think this ASX 200 share should have fallen as much as it has. Most of its revenue is linked to inflation, so it is capable of offsetting any cost increases.

It has grown its distribution for almost 20 years in a row, which is a great record, and it offers a solid distribution yield of more than 6%.

I think reducing interest rates could excite investors again about this business. Any success with its efforts regarding testing hydrogen in its pipelines could also be a long-term benefit.

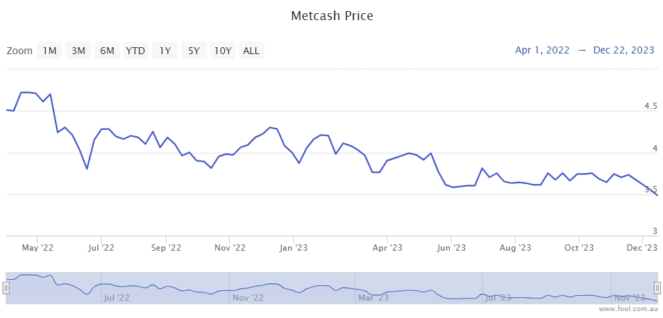

Metcash Ltd (ASX: MTS)

Metcash is a company that supplies various businesses including IGA, Bottle-O, Cellarbrations, Porters Liquor, IGA Liquor, Thirsty Camel and more. It also owns the hardware brands Mitre 10, Home Timber & Hardware, and Total Tools.

The Metcash share price is down 27% from April 2022, so it's a lot cheaper than before.

I think this ASX 200 share has a high-quality hardware division which is poised to do well the next time there is an uptick in confidence about the economy and the property market. I also believe the growing Australian population is helpful for growing the earnings of the food and liquor divisions.

One of the benefits of the lower Metcash share price is that it boosts the dividend yield. At the moment, the potential grossed-up dividend yield could be 8.4% in FY24, according to the projection on Commsec.

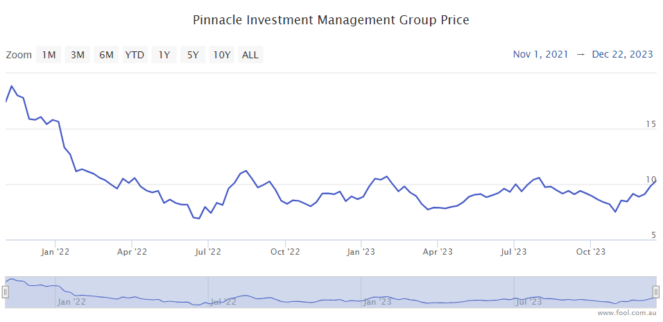

Pinnacle Investment Management Group Ltd (ASX: PNI)

This ASX 200 share helps fund managers start their own businesses. It can assist in areas like legal, compliance, seed funding, distribution, administration and so on. It allows the fund manager to focus on investing, and Pinnacle can benefit by owning a stake in the fund manager.

Pinnacle's success can be affected by how the market is going – weakness can lead to funds under management (FUM) of the fund managers falling, and may also mean households and institutions feel less motivated to give fund managers new money. In fact, a downturn may cause people to withdraw money.

The Pinnacle share price is down close to 50% from November 2021. With Pinnacle's underlying fund managers now seeing collective net inflows again, I think 2024 and beyond is shaping up to be positive.